2024 Small Business Trends

A Look at the State of Small Business in 2024

Guidant’s annual Small Business Trends report dives into the lives of over a thousand American small business owners, uncovering their top motivations, challenges, the state of their businesses, and beyond.

As we approach Election season this year, we’ve also sought the input of business owners when it comes to casting their ballots and assessing their overall confidence in today’s political climate.

Keep reading to discover the latest happenings in the world of small business — from election year insights to the top industry trends to exploring the aftermath of the great resignation.

Index

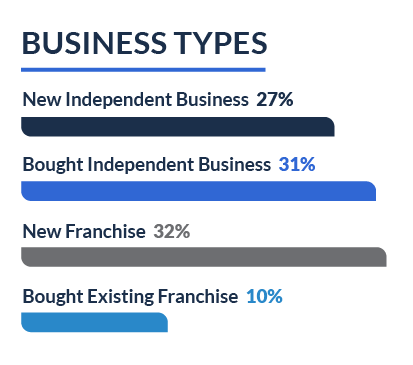

Independent vs. Franchise Businesses

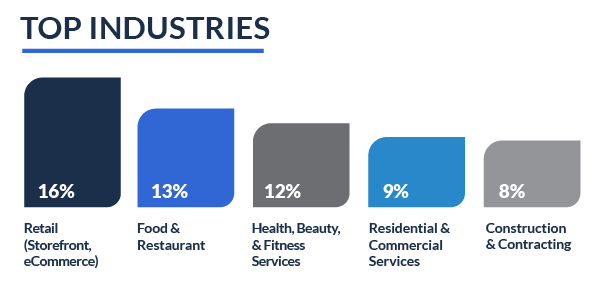

Top Leading Industries

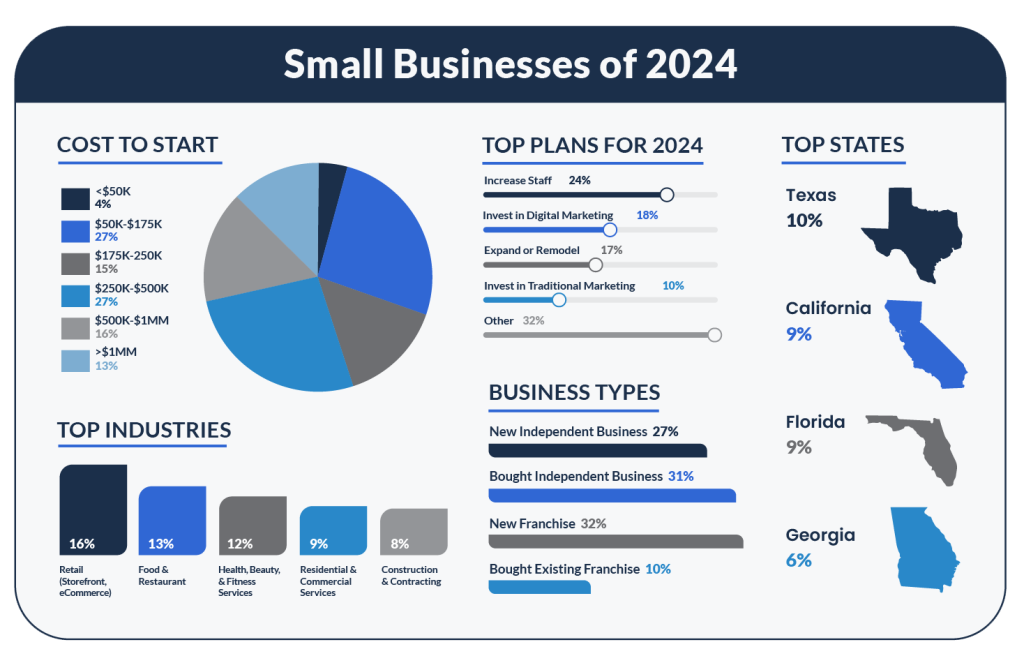

“Retail” (16%), “Food and Restaurant” (13%), and “Health, Beauty, and Fitness Services” (12%) remain the top three leading industries among small businesses surveyed since last year.

“Residential and Commercial Services” maintained fourth place at nine percent of businesses, while “Construction and Contracting” followed closely at eight percent.

“Business Services” (7%), “Lodging” (6%), “Education and Training” (5%) and “Manufacturing and Machining” (5%) all represented less than seven percent of all industries surveyed.

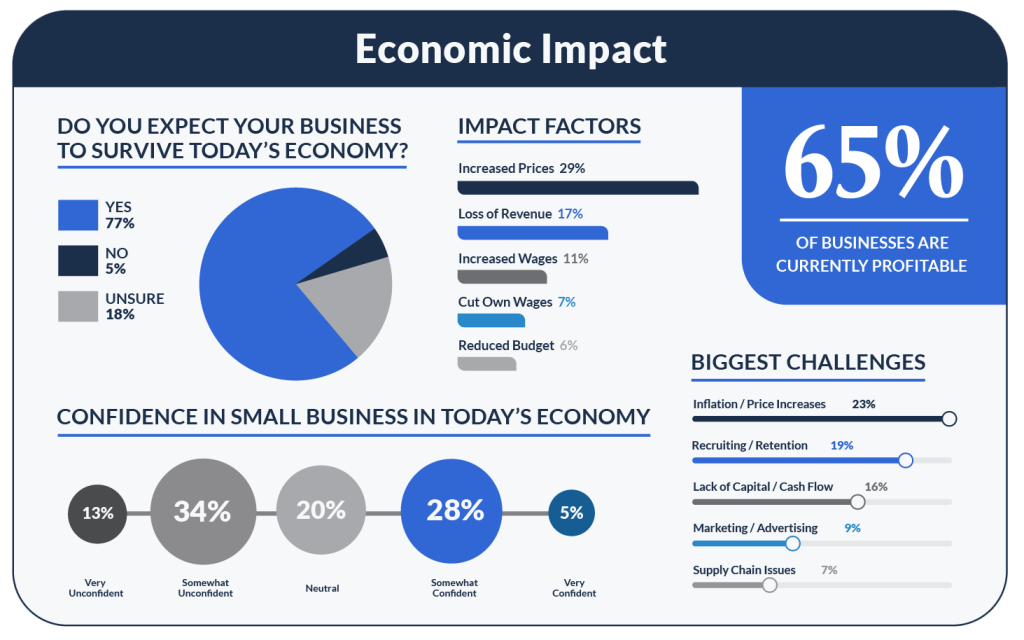

Top Small Business Challenges

In contrast to last year, when both recruitment/retention challenges and inflation/price increases were tied for the top spot at 22 percent, this year stands out with a noteworthy change.

This year, inflation and price increases have jumped to the forefront as a top challenge among small business owners — with 23 percent of respondents naming it their biggest concern. Recruitment and retention, which were one of the primary challenges in the previous year, have now dropped to second place at 19 percent.

Meanwhile, lack of capital and cash flow management remains a persistent concern for 16 percent of respondents. Fewer than ten percent of surveyed business owners identified challenges with marketing/advertising (9%), administrative work (8%), and supply chain issues (7%).

Aftermath of Economic Challenges

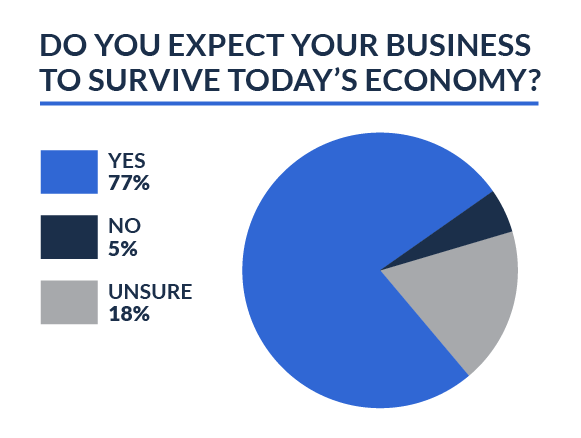

In today’s ever-changing economic climate, the resilience of small business owners is shining through — with a remarkable 77 percent expressing confidence in their ability to endure ongoing economic challenges. Such optimism serves as a testament to the determination and adaptability inherent in the entrepreneurial spirit.

However, a notable level of uncertainty remains, as 18 percent of business owners are unsure about their survival prospects. A smaller group, comprising five percent, anticipates not surviving these challenges — highlighting the economic challenges and severity faced by certain businesses.

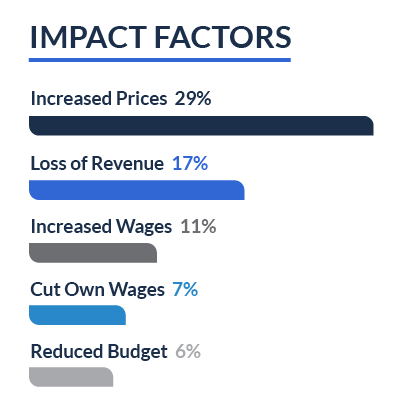

Additionally, 17 percent of small business owners have reported experiencing a loss of revenue, pointing to how economic instability has influenced both consumer spending and overall business performance.

Labor-related challenges also come to the fore, with 11 percent noting increased wages as a concern and seven percent reporting having to cut their own wages. In light of these economic challenges, six percent of respondents also took charge by reducing their budgets.

In brief, small businesses are navigating economic challenges with a blend of optimism and caution. While a majority are confident in their business’s survival, there’s still a significant degree of uncertainty — and a small segment of businesses that may face the real possibility of closing. The challenges of rising prices, revenue loss, and wage pressures are key economic stressors that small business owners are addressing as they evolve in today’s uncertain economic climate.

Measuring Happiness

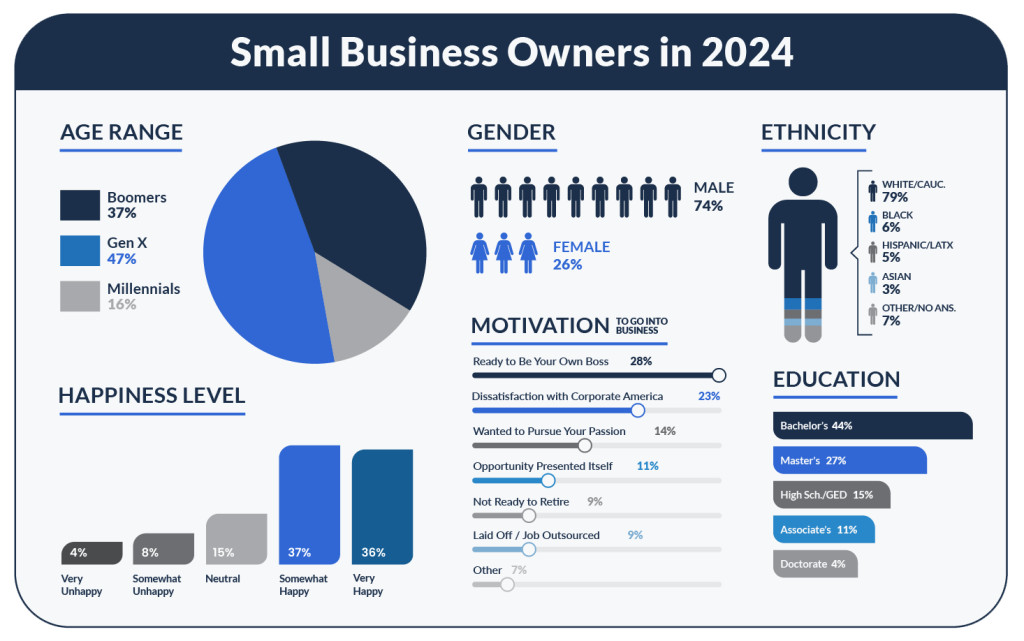

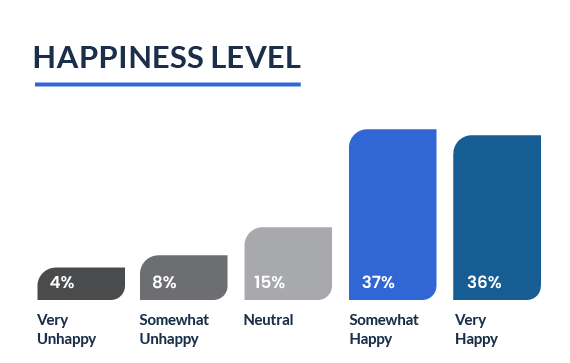

In this year’s study, we’ve seen a slight uptick in happiness levels among surveyed small business owners compared to the previous year (1%). In fact, our study reveals that a significant majority of entrepreneurs — totaling at 73 percent — report either being somewhat happy (37%) or very happy (36%) as business owners, suggesting a prevailing sense of fulfillment and satisfaction among small business owners. Fifteen percent of respondents report feeling “Neutral.”

Conversely, 12 percent of respondents expressed varying degrees of unhappiness, with eight percent being somewhat unhappy and four percent very unhappy. However, despite the varying challenges small business owners have faced within the past couple of years, these figures have remained relatively stable year-over-year.

Top Plans for 2024

AI in Small Business

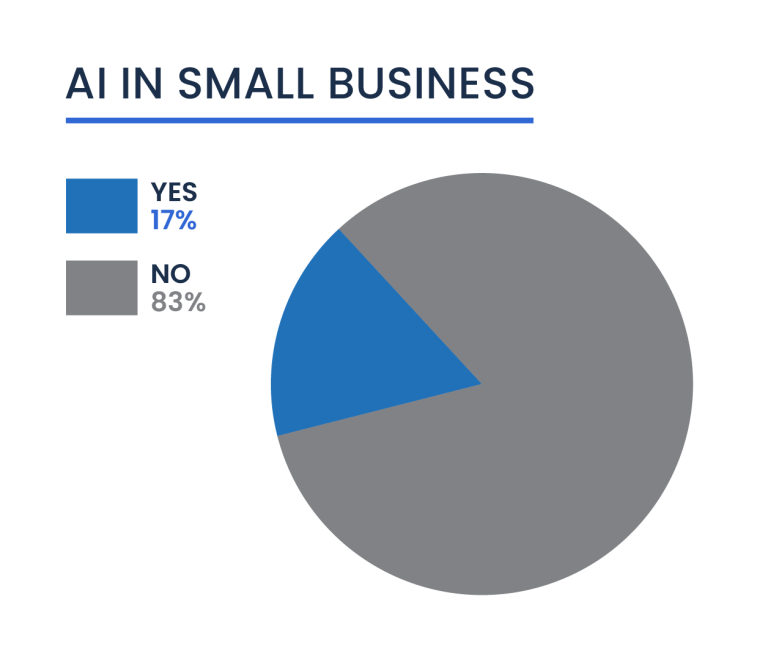

Of those using AI technology, a majority use writing tools, such as Chat GPT or Jasper (21%). Under five percent use image generation tools (4%) or inventory management tools (2%).

AI-driven solutions for small businesses are designed to enhance efficiency, decision-making, and competitiveness — but many businesses might not need to tap into AI. Some industries may rely on more traditional, hands-on methods. For example, only 1.2 percent of businesses in each “Food Services” and “Construction” sectors use AI, according to the most recent Business Trends and Outlook Survey (BTOS). Businesses in the “Information” sector, however, reported greater levels of AI use than the national average at 13.8 percent.

Many businesses may simply not yet see the necessity of incorporating AI technologies into their operations. According to a recent study from the U.S. Chamber of Commerce, the most common barrier to entry for this technology is the education gap — as 77 percent of small business owners expressed uncertainty about using AI or claim its benefits are unclear.

Business Financing Trends

Profitability

Sixty-five percent of small business owners have reported that their businesses are currently profitable — a majority that indicates a trend toward financial success among American small businesses. However, the remaining 35 percent are not currently profitable, highlighting the challenges faced in the sector. It should also be noted that many of surveyed respondents are newly-fledged businesses — and new businesses take an average of two to three years before reaching profitability. In fact, nearly one-third of businesses (31%) were in their fledgling stages, with three years or less of establishment.

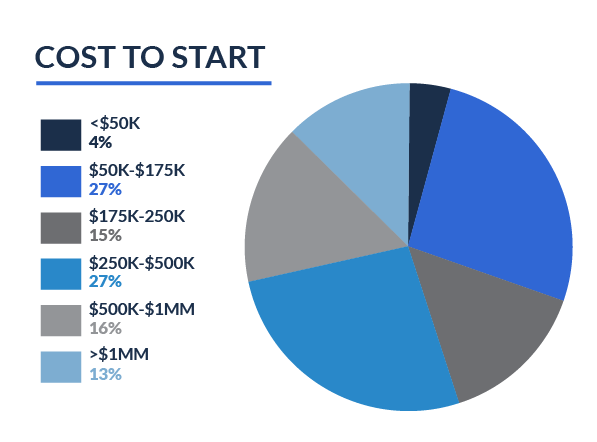

Cost to Launch

How expensive is it to start a business in 2024? With prices on the rise, the overall cost of starting a business remains relatively high.

A small fraction of entrepreneurs, accounting for only four percent, managed to start their ventures with less than $50,000. This indicates a group of businesses operating in low-cost or highly resource-efficient sectors. In the next tier, 27 percent of business owners reported initial costs ranging between $50,000 to $175,000, suggesting a slightly higher but still moderate level of investment requirement for startups.

Moving upward in the cost spectrum, 15 percent of the respondents indicated their startup costs fell between $175,000 and $250,000, while another 27 percent reported costs in the brackets of $250,000 to $500,000. These figures point to a significant portion of small businesses needing substantial capital to get off the ground, likely due to higher operational or equipment costs or entering markets with greater entry barriers.

Interestingly, the data shows a significant representation in the higher investment categories as well. Twelve percent of small business owners reported initial costs of $375,001 to $500,000, and 16 percent fell into the $500,001 to $1 million range. This could reflect businesses in industries that require extensive upfront investment, such as technology or manufacturing. A noteworthy 13 percent of entrepreneurs launched their businesses with an investment exceeding $1 million, indicating ventures of a significant scale, possibly in sectors with high entry costs or those requiring extensive research and development.

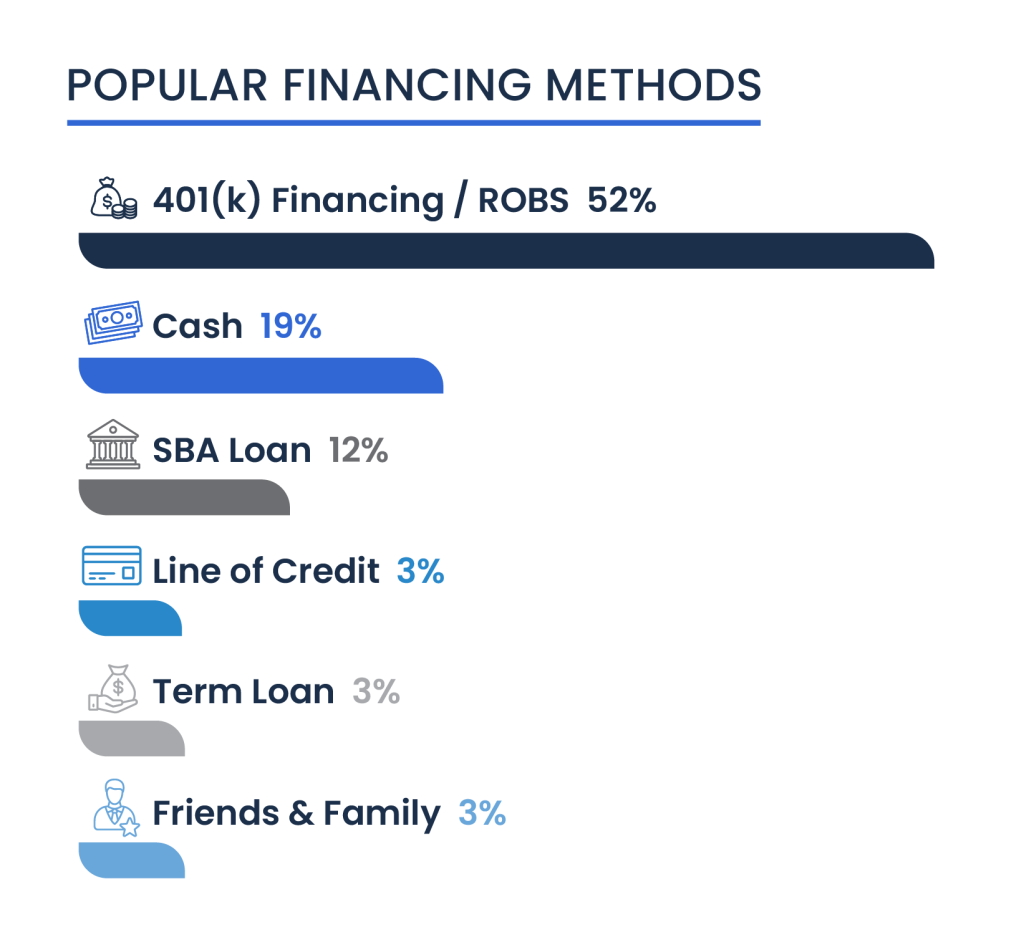

Popular Business Financing Methods

In ranking the most popular methods for financing small businesses, our study surveyed over 1,000 current and aspiring small business owners working with Guidant.

Over half of the business owners in our survey (52%) have utilized 401(k) business financing, also known as Rollovers for Business Startups (ROBS), to fund their business ventures this year. ROBS is an innovative debt-free funding solution, allowing for entrepreneurs to tap into their retirement savings to fund or start a business without early withdrawal penalty fees. It’s important to note that a significant number of respondents are clients of Guidant Financial, the leading provider of ROBS in the U.S..

Following ROBS, 19 percent of business owners reported using cash as their primary financing method. This further indicates a preference for avoiding debt, especially in today’s changing economy.

The Small Business Administration (SBA) loans come in third, chosen by 12 percent of respondents. SBA loans are known for their often favorable terms, including lower down payments and flexible overhead requirements, making them a preferred choice for many entrepreneurs.

Other financing methods, such as lines of credit, unsecured term loans, and borrowing from friends and family, each account for three percent of the responses.

Further down the list, only two percent of respondents used unsecured loans and Home Equity Line of Credit (HELOC) each.

Interestingly, only one percent of respondents opted for equipment leases, peer-to-peer loans, or other unspecified methods. Surprisingly, no respondents reported using refinancing existing mortgages, portfolio loans, or crowdfunding. This lack of diversity in the lower rankings may reflect the specific clientele of Guidant and their preferences or the relative accessibility of these financing options.

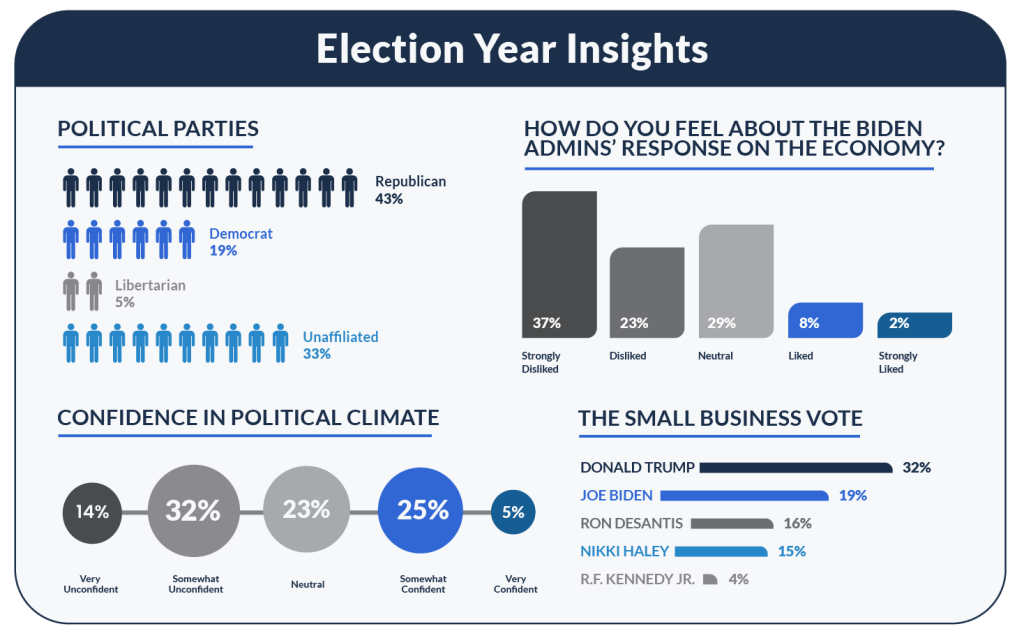

Election Year Insights: Mapping Small Business Politics

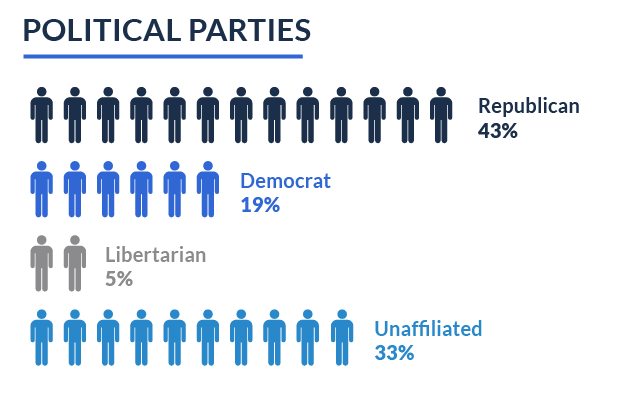

Small Business Owners Lean Conservative

According to our survey, a significant portion of small business owners lean conservative, with 43 percent identifying as Republicans. Nineteen percent of the share identified as Democratic, while only five percent considered themselves Libertarians.

Another substantial 33 percent of respondents feel unrepresented by any political party, marking a sustained increase in the number of unaffiliated business owners. From 2022 to 2023, our study noted a 22 percent increase in respondents who feel disconnected from political parties. This year, we continue to see a slight upward trend (1%).

This streak of independence highlights the fact that a significant group of entrepreneurs are choosing to distance themselves from established political norms, possibly shaped by their perception of government support for small businesses in recent years. However, more and more Americans are identifying as Independents overall.

According to a recent poll from the Gallup News, political Independents continue to make up the largest group in the U.S. at 43 percent among U.S. adults. Independents have also consistently been at 40 percent or higher every year since 2011 (except for 2016 and 2020). Democrats and Republicans both tied at 27 percent of their share in 2023.

The spectrum of political beliefs within the small business community highlights the intricate makeup of this demographic. While most tend toward conservative viewpoints, a significant portion also opt for a non-partisan stance — following a general trend of independence in the U.S.

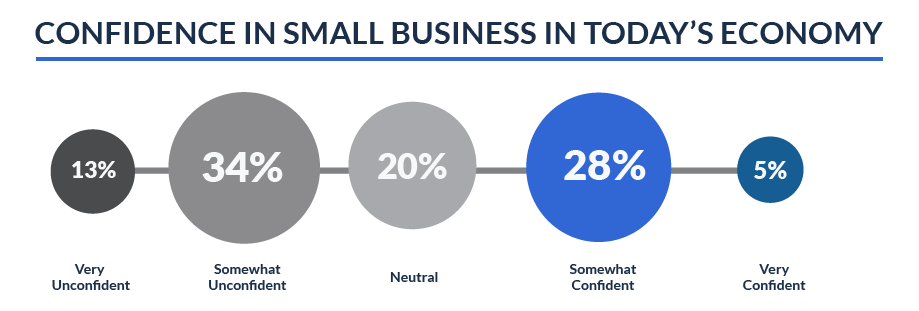

Political Confidence Among Small Business Owners

In our ongoing study of small business trends, we’ve delved into an intriguing topic in recent years: the political confidence of American small business owners.

According to our survey this year, a notable 14 percent of small business owners reported feeling “very unconfident” in today’s political landscape, while an additional 32 percent expressed being “somewhat unconfident” — revealing that a significant proportion of small business owners hold political uncertainties.

Twenty-three percent of respondents indicated a “neutral” stance, suggesting another substantial segment of small business owners neither exude nor lack confidence in today’s politics. On the flip side, 28 percent expressed being “somewhat confident,” reflecting a group that retains a degree of faith in the current political climate. Only five percent reported feeling “very confident.”

Year over year, our data reveals a notable decline in political confidence among small business owners. In 2020, a substantial 60 percent fell into the “somewhat to very confident” category, showcasing a high level of political optimism. However, subsequent years saw this number decline to 41 percent in 2021, rise slightly to 47 percent in 2022, dip to 34 percent in 2023, and land at 30 percent in 2024. This data highlights the fluctuating levels of political confidence within the small business community, driven by a combination of factors such as economic conditions and policy changes.

Small Business Owners Voice Discontent with Current Economic Policies

In the span of the past three years, the U.S. has witnessed a surge in entrepreneurship, with a record-breaking 16 million new business applications. Over five million new business applications were filed in 2023 alone. What’s more, the monthly average of 440,000 new business applications during the first three years of the Biden-Harris Administration surpasses the combined average of the previous four years by a remarkable 46 percent. However, despite this promising growth, a majority of our respondents express dissatisfaction with President Biden’s economic response.

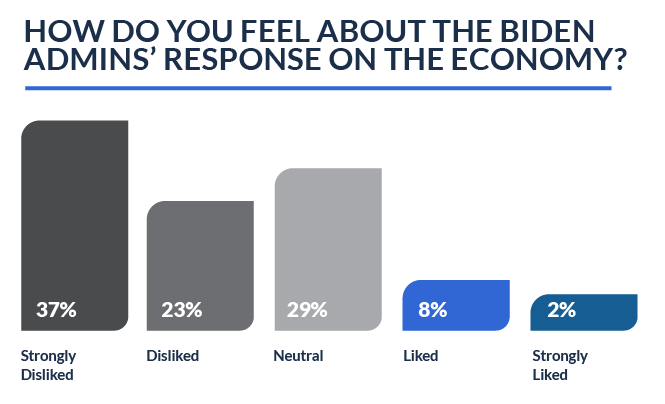

In fact, over half of small business owners either strongly disliked (37%) or disliked (23%) the Biden-Harris administration’s response to the current economic climate. Another significant amount remained “neutral” (29%), while only 10 percent approved the administration’s approach.

When asked if they felt the government should put more effort into supporting small businesses, 71 percent said “Yes.” Thirteen percent said “No,” while 16 percent remained undecided.

Over the past three years, the Biden-Harris administration has introduced several policies aimed at supporting small businesses. Notable initiatives include the State Small Business Credit Initiative (SSBCI), which allocated over $50 million to 20 states to provide advisory services, benefiting thousands of small businesses in underserved communities. The American Rescue Plan (ARP) played a crucial role in offering financial security to entrepreneurs, distributing over $400 billion in relief to more than six million small businesses. Additionally, the administration’s Investing in America Agenda —encompassing the Bipartisan Infrastructure Law (BIL), CHIPS and Science Act, and Inflation Reduction Act (IRA) — has further facilitated conditions for small business success. Congress has also modernized the Small Business Administration (SBA), significantly improving lending, technical assistance, and other programs.

Nevertheless, despite these efforts, many small businesses have expressed dissatisfaction, perhaps mainly due to new regulations. For example, the Corporate Transparency Act passed in 2021 requires small businesses to register with the Financial Crimes Enforcement Network (FinCEN) in 2024 — potentially leading to increased administrative burden, higher costs, and penalties for non-compliance. Some businesses may have also been impacted by the IRA, experiencing higher audit rates than in previous years due to an increase in IRS funding.

It’s important to recognize that the impact of these policies varies widely among small businesses, depending on factors like industry, location, and other specific circumstances. While some businesses have greatly benefited from these initiatives, others have found them less helpful or even burdensome. According to our data, there is an opportunity for the government to step up more of its efforts in supporting small businesses.

Election Season: The Small Business Vote

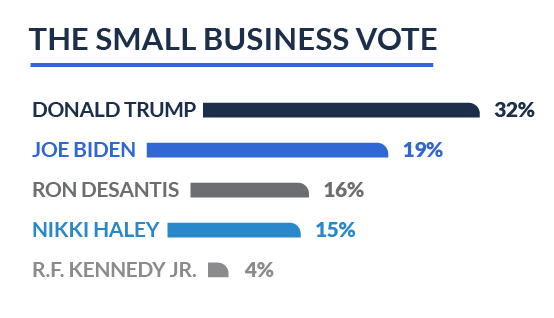

Among the respondents, 32 percent expressed support for Donald Trump, representing a significant portion of the sample. Joe Biden garnered the support of 19 percent of the surveyed small business owners, indicating a relatively lower level of backing compared to the former president.

Ron DeSantis secured 16 percent of the votes, while Nikki Haley followed closely behind with 15 percent, showcasing a level of popularity almost on par with the incumbent president. Additionally, Vivek Ramaswamy, Robert F. Kennedy Jr., and Chris Christie each received support from around three to four percent of respondents. These insights underscore the diversity of opinions among small business owners during this election year.

From Dream to Reality

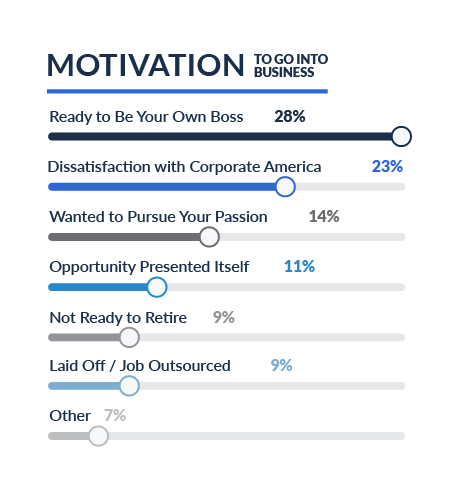

Many also reported “dissatisfaction with corporate America” as a key motivator (23%). These two primary driving factors suggest a growing trend among Americans to break free from the corporate world and carve out their entrepreneurial paths.

Passion is another big motivator. Among the respondents, 14 percent became business owners because they wanted to pursue their passions. A significant amount also reported going into business ownership because an opportunity presented itself (11%).

Nine percent of respondents decided to start a business after being laid off, while another nine percent weren’t ready to retire yet. A smaller portion was inspired by a new business idea (5%), and only two percent transitioned into business ownership in response to a life event.

A New Generation of Business Owners: Millennials on the Climb

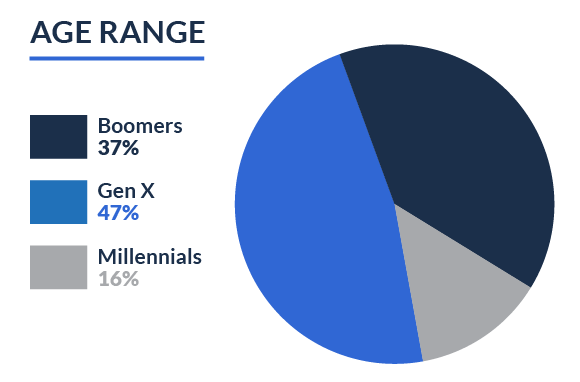

The generation gap between Millennial (23 to 38 years old) business owners and earlier generations — while still steep — is closing in. In fact, we’ve seen a significant shift in business ownership over the past year.

Millennial business owners have risen by a remarkable 27 percent since 2023, showing their growing influence and presence in the world of small business. That means the generational divide in small business is narrowing — and it’s happening faster than we’ve ever seen before.

The Baby Boomer (55 to 73 years old) generation, long considered the backbone of business ownership, has experienced a seven percent drop in representation since last year. Meanwhile, Generation X (39 to 54 years old) remains a strong presence, representing nearly half of business owners in our study.

The Diversity Divide in Business

While commendable initiatives such as the Business Diversity Principles (BDP) Initiative from the Department of Commerce and the Expansion of Women Business Centers (WBCs) aim to promote inclusive capitalism and equitable economic growth, our data reveals that small business ownership remains predominantly white and male-dominated.

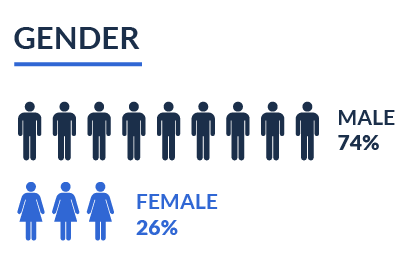

Among our respondents, a substantial 74 percent of small businesses are owned by men. In comparison, women account for 26 percent of business ownership. It’s worth noting that there is forward momentum, with a three percent growth in women business owners since last year’s study.

According to the 2024 Wells Fargo Impact of Women-Owned Business Report, conducted in partnership with Ventureneer, CoreWoman, and Women Impacting Public Policy (WIPP), women-owned businesses experienced almost double the growth rate of their male counterparts between 2019 and 2023. Remarkably — in the span of just one year — the growth rate increased by 4.5 times from 2022 to 2023. The report also showed that “Black/African American” and “Hispanic/Latino” women-owned businesses experienced a much higher growth rate than all women-owned businesses. Between 2019 and 2023, “Black/African American” women-owned businesses saw average revenues increase by 32.7 percent and “Hispanic/Latino” women-owned businesses by 17.1 percent compared to all women-owned businesses’ 12.1 percent rise.

While the findings of this report indicate a positive shift toward diversity in small businesses, it’s important to acknowledge that more progress needs to be made.

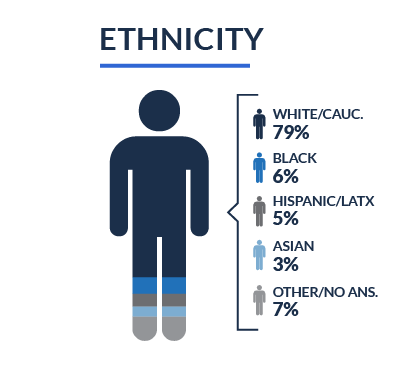

Beyond gender diversity, our study also underscores the need for greater ethnic and racial inclusivity in small business ownership. The majority of participants continue to identify as “White or Caucasian” (79%) — and there is a notable underrepresentation of “Black or African-American” (6%), “Asian or Asian-American” (3%), “Hispanic, Latino, or Spanish Origin” (5%), “Indigenous American, Native Hawaiian or Pacific Islander” (1%), and “Middle Eastern or North African” (1%) individuals in small business ownership.

Acknowledging these disparities is essential for promoting a more inclusive and representative small business landscape that reflects the rich diversity of America’s population. As we move forward, it’s important to remember that fostering diversity and inclusivity in small business ownership is not only a matter of equity but also serves as an avenue to drive greater economic prosperity for all.

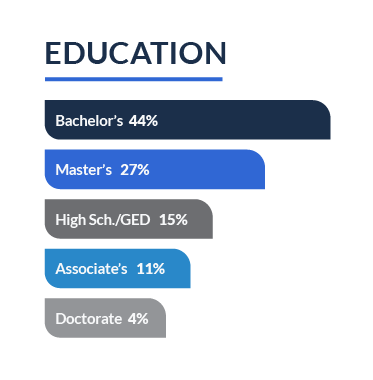

Educated Entrepreneurs

Education continues to be a pillar of excellence in the world of entrepreneurship. Nearly half of our respondents have attained a bachelor’s degree (44%), equipping them with a solid foundation in their respective fields. Additionally, 27 percent hold master’s degrees, bringing advanced expertise and insights to their businesses. Another 11 percent possess associate degrees, while a smaller — but impactful — four percent hold doctorate degrees. Altogether, 85 percent of surveyed business owners hold post-secondary degrees.

High school graduates, or those with a GED, make up 15 percent of the group. This mosaic illustrates that success in small business ownership is achieved through a combination of education and experience.

Is the Great Resignation Over?

Recruitment Relief

Though recruitment and retention consistently rank as top challenges among surveyed small business owners, there has been a noticeable decline in the number of business owners identifying them as their primary concerns this year — suggesting a potential trend toward greater ease in hiring and retaining employees within the small business sphere.

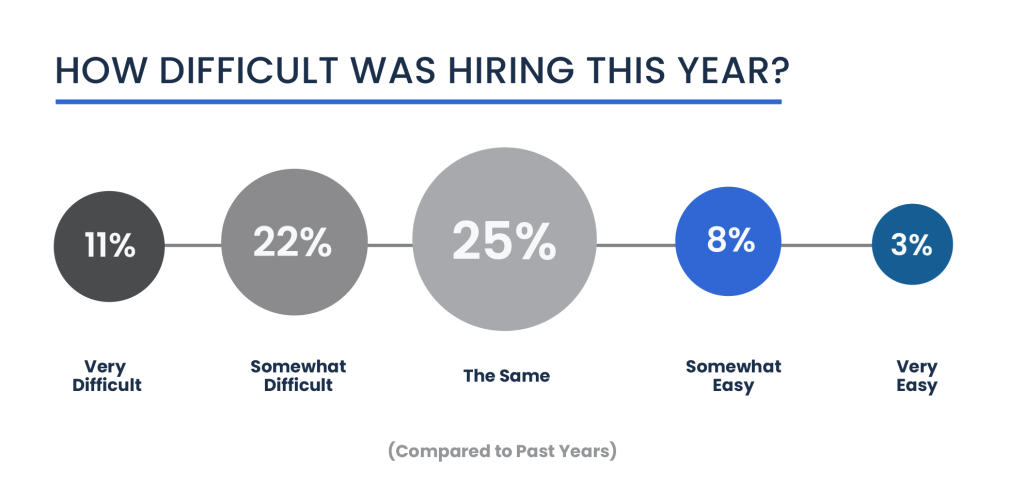

We found substantial changes when comparing this year’s responses to last year’s. The percentage of business owners who found recruitment and retention “very difficult” compared to previous years decreased by 52 percent, while those who found it “somewhat difficult” decreased by 11 percent. These numbers show a significant improvement in hiring experiences.

Most small business owners found the hiring process the same compared to previous years (25%), while 11 percent found the hiring process somewhat (8%) to be very easy (3%) compared to previous years.

However, it’s important to note that 30 percent of respondents reported not hiring anyone in the past year, representing a 24 percent year-over-year increase. Many business owners also reported the hiring process as somewhat (22%) or very difficult (11%) compared to previous years. This could be influenced by various factors, including changes in business operations or workforce dynamics.

While recruitment and retention remain important concerns, small business owners’ changing perceptions and experiences suggest a positive shift toward improved recruitment and retention conditions — potentially marking the end of the great resignation era.

An Easier Path to Talent

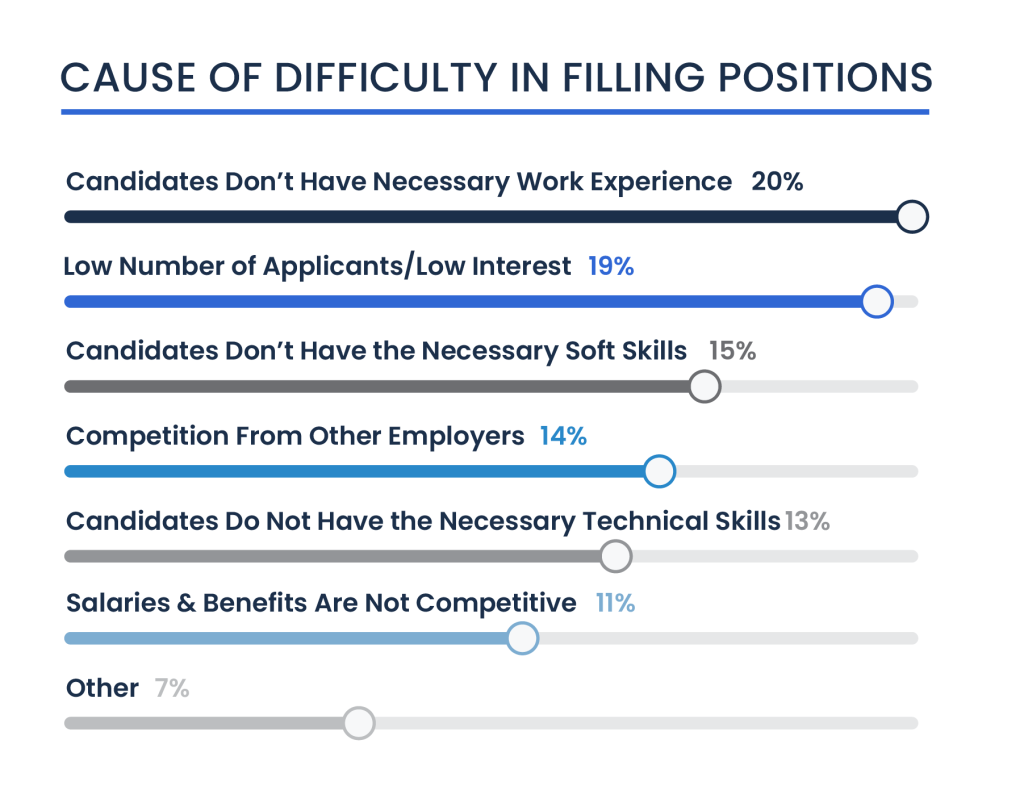

This year, we have seen a significant shift when it comes to talent acquisition. Notably, small business owners surveyed have reported a remarkable 29 percent decrease in the issue of a low number of applicants or a lack of interest in their organization compared to the previous year.

This decline in the number of applicants or the lack of interest signifies a positive trend, suggesting that small businesses are finding it easier to attract potential candidates. In contrast to the 27 percent of respondents who encountered this challenge in the past year, a decreasing number now perceive it as a primary obstacle in their hiring efforts (19%).

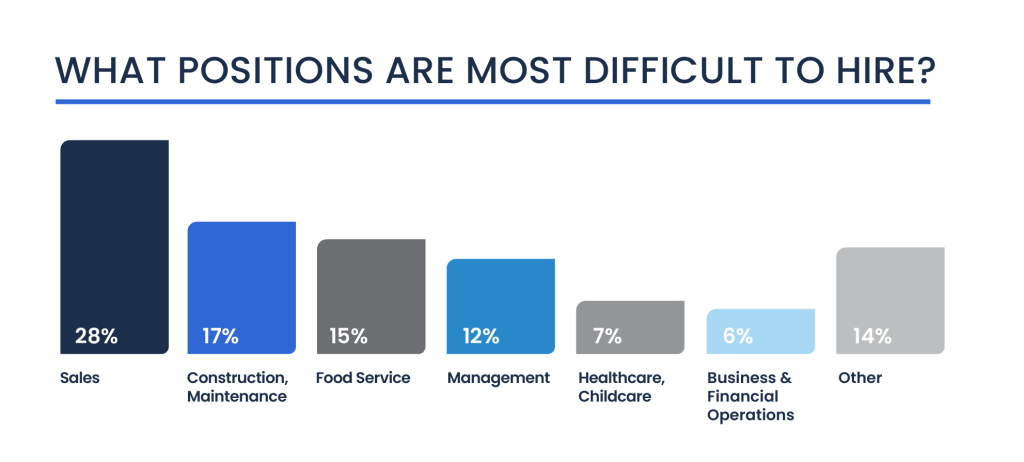

Our study further revealed that specific job roles presented more difficulty in recruitment than others. Sales and related roles topped the list, with 28 percent of respondents finding them the most challenging to fill. Following closely were positions in construction, maintenance, installation, and production (17%), food service (15%), and management roles (12%).

To sum up, fewer small business owners struggle to find enough applicants — which is a good sign for hiring. But they still face hurdles when it comes to finding the right candidates and dealing with competition. These factors could be why many small business owners are choose to “fly solo” this year…

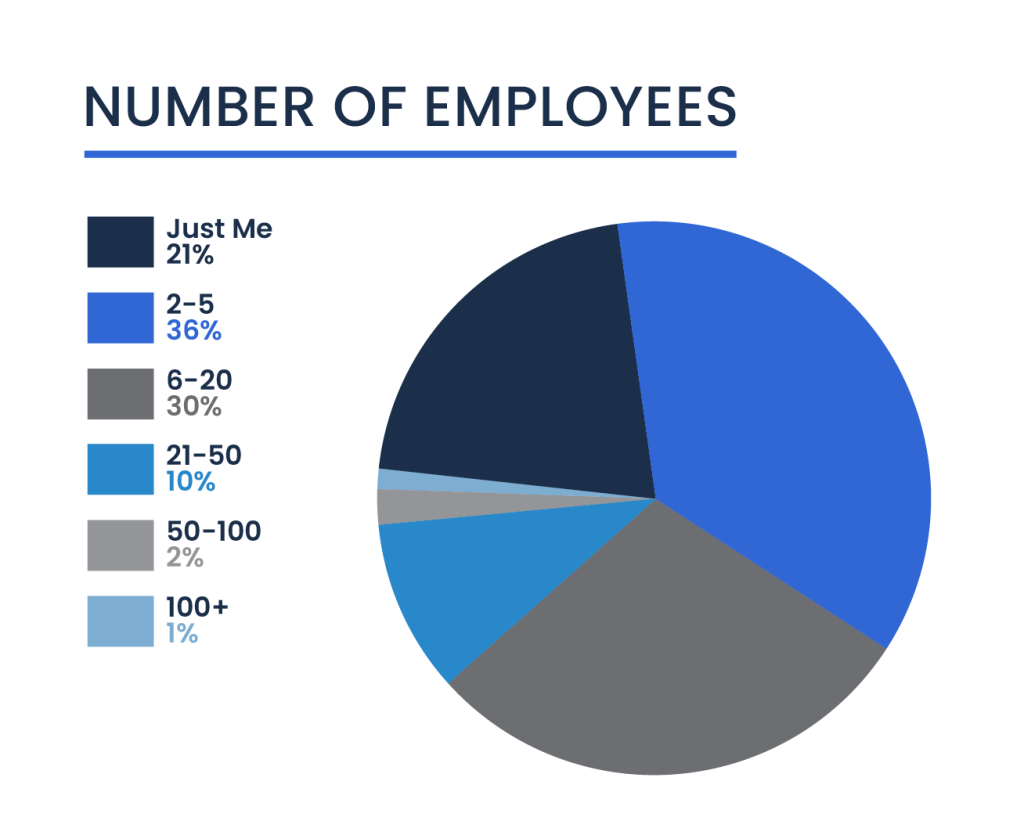

Flying Solo

Many business owners — accounting for 21 percent — are solo entrepreneurs, marking a notable five percent increase in the number of people surveyed who run their small businesses alone compared to last year.

A majority of respondents, comprising 36 percent, maintain small teams with two to five employees, indicative of the commonality of tight-knit workforces in small businesses. Additionally, 16 percent of business owners reported having slightly larger teams, employing six to ten individuals.

Beyond that, we noticed a spectrum of business sizes within the small business sector. Eight percent of respondents oversee enterprises with 11 to 15 employees, six percent manage businesses with 21 to 30 employees — and four percent have reached a level of complexity with 31 to 50 employees.

Defying Uncertainty: The Growth of Small Businesses

This year’s study offers an exclusive look into the resilient and bold spirit of American small businesses in the face of economic and political uncertainty. These entrepreneurs, mostly driven to escape corporate America or be their own bosses, are forging ahead despite increasing costs and staffing challenges. Impressively, most are not only profitable — but also looking to expand in the coming year, bracing for future challenges with optimism.

As we navigate through an election year, the report gains an added dimension by capturing the political sentiments and preferences of small business owners. Numerous respondents have expressed unease about today’s political climate and advocate for more government backing for small businesses. Echoing these concerns, a majority display conservative tendencies and are gearing up to cast their votes for the Republican party.

This year’s findings are particularly significant in the context of the ongoing aftermath of the great resignation, which has reshaped labor markets and business operations across the country. Although finding and keeping employees continues to be a major challenge for business owners, our research indicates a promising trend of improvement, with fewer small business owners facing difficulties in attracting and hiring skilled workers.

By exploring these various facets, from election year perspectives to the latest industry trends, this year’s study is an invaluable resource for anyone looking to understand the current state and future prospects of small businesses in America. Whether you’re an aspiring entrepreneur, a seasoned business owner, or a policymaker, this report offers crucial insights to help navigate the ever-changing world of small business.

Additional Learning Resources

Ready to use your retirement funds to start your business?

No more questions about ROBS? Great! Let’s get the process started today.