Rollovers for Business Startups (ROBS) is a flexible financing strategy for small businesses with multiple advantages. ROBS uses 401(k) or other qualified retirement funds — which often constitute the single largest savings people have — as funding. But the question may arise: Can you use ROBS funding if you’re still employed? After all, starting a business while still employed can provide income stability as you build your own company, so many people want to begin navigating the entrepreneurial waters that way.

The answer is yes; you can use ROBS while employed. However, doing so can be complex, raising issues ranging from understanding compliance nuances to strategic planning for the optimal use of retirement funds. In this article, we’ll demystify how to use ROBS financing while you’re working for another company so you can leverage 401(k) business financing without letting go of your job.

Does your retirement plan qualify for ROBS? Check out 10 Types of Eligible Retirement Funds for ROBS to find out.

Using Retirement Funds as Small Business Financing

Because retirement savings are often a large source of assets, it may have already occurred to you to withdraw from your 401(k) or other qualified plan, such as a traditional Individual Retirement Account (IRA), 403(b) or Thrift Savings Plan (TSP) to fund your startup. But doing so without using the ROBS method can be disadvantageous.

First, if you’re under 59½, the Internal Revenue Service (IRS) will slap a 10 percent early withdrawal penalty on any retirement savings you withdraw. Second, the IRS will levy income tax at the applicable rate on all funds you withdraw in addition to the penalty. As a result, after taxes, the funds available to you may be considerably less than you actually withdrew.

A 401(k) rollover using ROBS allows you to withdraw 401(k) or other qualified funds at any age — without any tax penalty fees. But how does ROBS work?

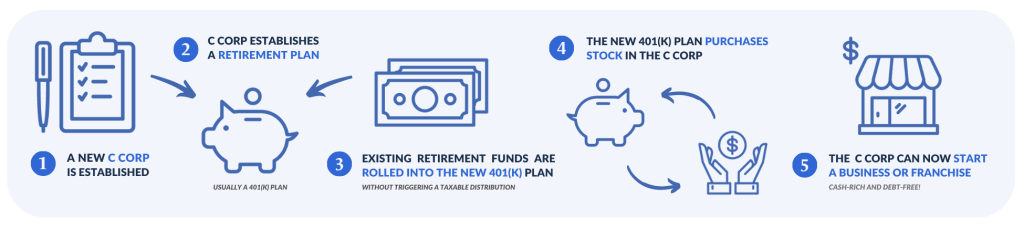

First, you must create a type of business entity known as a C Corporation (C Corp). Other structures, such as sole proprietorships, S Corporations, and limited liability companies (LLCs), are not allowed. (However, you can setup a C Corp to run an LLC.)

The C Corp then establishes a retirement plan for the new company, most commonly a 401(k). The new retirement plan must be open to all company employees, including you. After the retirement plan is created, the retirement funds you want to use are transferred into it. Once transferred, those funds are utilized to purchase stock in your C Corp. Your new company can use that money for any business purpose, such as purchasing a franchise, buying equipment, renting or purchasing offices, and more.

Generally, aspiring business owners should have at least $50,000 in retirement funds to use when considering ROBS.

How ROBS Works

Learn more about how ROBS works in What is ROBS? How 401(k) Business Financing Works.

Using ROBS While You’re Employed

There are two scenarios for using ROBS while you’re employed. In the first scenario, you may have 401(k) or other qualified retirement funds from a former employer held by that former employer or another institution (such as a bank). In this scenario, you can use ROBS whenever you want, assuming you are fully vested in the money, regardless of age. The money is yours — and ROBS lets you withdraw it without tax penalty fees.

In the second scenario, you have qualified retirement funds at the company for which you currently work. This scenario is known as an “in-service rollover.” There are two options for an in-service rollover, depending on your age:

- 59½ or older: You may roll over the entire balance of your current retirement plan’s assets into a new retirement fund.

- Younger than 59½: You may only roll fully vested, employer-matched funds into a new retirement account.

Not every employer’s plan supports in-service rollovers; this varies based on the plan’s specific terms and policies. It’s important to consult your plan administrator and refer to your 401(k) summary plan document to understand the exact guidelines applicable to you. If your plan permits it, you might need to meet certain criteria to be eligible, such as:

- Being at least 59½ years old

- Providing proof of disability

- Having a 401(k) account that is 2-5 years old

- The account must no longer be active

If you’re considering an in-service rollover, you’ll want to check if your employer’s plan supports them and its eligibility criteria, as this can vary.

Note: Plans allowing in-service rollovers often set conditions on how soon you can continue making 401(k) contributions after a rollover.

Advantages of Using ROBS While Employed

Using ROBS has a number of financial and business advantages for new small business owners, including the following:

1. No Debt Service Payments

All startups need cash flow to operate. However, most forms of financing can be a threat to robust cash flow. Even a small loan or line of credit can saddle a beginning business with monthly debt service payments, which is taken from cash flow. With ROBS, you’ll have no debt service – giving your business a cash-rich jumpstart. This makes ROBS a particularly popular financing option, especially when interest rates are on the climb. More and more entrepreneurs are opting for ROBS to eliminate or have less business debt.

2. No Credit Score or Other Lender Requirements

Loans, business credit cards, and lines of credit are all common small business financing options. All, though, require business owners to go through an application process with a lender. Lender requirements can be very stringent, and approval can be difficult. This is especially true if you’ve encountered challenges that may have affected your credit score; most lenders require a good to excellent score.

But credit scores aren’t the only requirement. Many lenders require collateral, including potentially a house or other property, before they approve a loan. Many also require a large down payment. Entrepreneurs may have to prove that they have a solid business reputation in their community or industry, which can be difficult if they’re just starting the business.

With ROBS, you don’t need a credit score, collateral, down payment, or any proof of prior business experience and success.

3. Reasonable Approval Times

Loans can take months to be approved – and popular loan types, such as those backed by the U.S. Small Business Administration (SBA), take the longest. ROBS, on the other hand, can be set up in much less time, allowing you to use the funds within roughly four weeks.

4. Can be Combined with Other Funding Sources

ROBS funds can be combined with other business funding sources to maximize your business financing. ROBS funds can, for example, be used as a down payment on a small business loan, which can optimize your ability to get funding.

Thinking of using ROBS as a down payment on a business loan? See Using Your 401(k) as an SBA Loan Down Payment — Penalty-Free for more information.

Setting Up and Administering ROBS Wisely: What To Know and What to Do

While ROBS can be a great business financing strategy, ROBS transactions can also be complicated. These often complex transactions are subject to laws, rules, and regulations from both the IRS and the U.S. Department of Labor (DOL). Failure to adhere to these can expose you to fines and other actions.

It’s highly advisable to work with qualified ROBS specialists or financial advisors, such as Guidant Financial, in the process. We can set up ROBS funding for your company, making sure ROBS is performed correctly — so you don’t run the risk of penalties and fines. We can also administer ROBS on an ongoing basis, ensuring that you stay compliant with government regulations. For example, you must file Form 5500 annually. It can be very time-consuming for small business owners to keep current with and comply with all mandates themselves.

Remember, the new retirement plan must be open to all employees. Failure to do so, or the establishment of a system under which some employees are eligible for it and some not, can result in government challenges and fines. A ROBS administrator can help small business owners avoid this and similar challenges.

Note: We recommend working at least 500 hours per year for your company. That’s about twenty hours per week.

Learn everything you need to know about ROBS in our Complete Guide to Rollovers for Business Startups.

Can I Pay Myself a Salary If I Use ROBS?

Because aspiring business owners may want to keep their current jobs to ensure a steady salary, wondering if they can also pay themselves a salary for the new business they’re starting with ROBS funding is a common question.

The answer is yes, you can definitely pay yourself a salary from the new company. In fact, in many cases, you should. Why? The answer is very related to ROBS and the compliance associated with ROBS funding.

Federal government regulations require that all rollover participants must be bona-fide, active employees. You cannot be a silent investor or an absentee owner. One of the easiest ways to demonstrate compliance with these regulations is to pay yourself a salary for the work you do and the title you have.

What if you have just started the business and can’t fully determine what a prudent salary would be given fledgling cash flow? That’s a very good question. At Guidant, we often recommend that beginning business owners wait until they have operating revenue to pay themselves a salary. Why? Because the DOL in particular will question whether your or any employee’s salary is coming out of the retirement fund proceeds directly. Waiting for operating revenue makes clear where the salaries are coming from.

You also need to make sure the pay reflects the workload you are taking on. The Federal government requires that all people investing retirement funds into a company believe that it is a prudent and judicious use of the money. Therefore, as a business owner, you must handle the rollover funds with care. In addition, as a fiduciary and trustee of the new retirement plan, you need to act in the best interests of the new retirement plan and its beneficiaries. Paying yourself (or anyone else) a salary far above the customary salary for their work or job title is not in those best interests.

Whether you’re a prospective or current business owner, knowing how to pay yourself is key. See How to Pay Yourself as a Business Owner.

How Guidant Financial Can Help With ROBS Funding

Unlock your entrepreneurial dreams with Guidant Financial. With over 30,000 small businesses successfully launched through ROBS arrangements and more, we’re experts in small business financing. Specializing in setting up and managing ROBS rollovers, we ensure your venture meets all compliance and administrative requirements seamlessly.

Ready to transform your business aspirations into reality? Contact us today to discover how ROBS can be your stepping stone to success. And if ROBS isn’t right for you, our financial experts can help you explore other funding options — and tailor a custom-made business financing strategy to fund your business venture.

Call us today at 425-289-3200 for a free, no-pressure business consultation to get started — or pre-qualify in minutes for business financing now!

“When Falling Sky Brewing presented itself as a great opportunity for me, I needed the capital. Traditional lenders weren’t going to do it. I took a chance on myself that I could grow my business and my 401(k)… And I thought, ‘You know what? I could do this without overhanging debt.‘”

— Stephen Such, Falling Sky Brewing

Read the stories of REAL small business owners who work with Guidant.