Did you know that Guidant Financial has helped launch 30,000 businesses in the last 20 years? And many of those have been done with Rollovers for Business Startups (ROBS), also known as 401(k) business financing. While most use their 401(k) for business funding through the ROBS program, nearly every retirement plan can be used with this strategy.

Helen Guo from SMB Deal Hunter interviews Jeremy Ames, co-founder and CEO of Guidant Financial. They discuss key topics about how entrepreneurs like you can use their 401(k) or other retirement funds to finance business ventures through the ROBS program. Ames explains the process, which involves setting up a C Corporation and rolling over retirement funds to make them an investor in the business, enabling business ownership without borrowing from savings.

The interview also touches on how Guidant Financial offers comprehensive services, including audit protection and ongoing compliance with IRS regulations. Ames highlights the additional support Guidant provides, such as payroll and bookkeeping, to ensure small business owners can focus on growth.

Below, you’ll find key highlights from the interview with Ames, featured on the SMB Deal Hunter with host Guo.

Getting Started

As for how Ames got started, it was in real estate. He also connected with David Nilssen, the other co-founder of Guidant and longtime business partner of Ames.

The two purchased a plot of land on the Washington state peninsula and were going to subdivide it and put down mobile homes. As they were working on it, they met with attorneys who let them know they could use retirement funds to invest.

“We had no idea,” Ames said. “At this point, our understanding was that you could only invest your retirement funds in boring stuff like mutual funds and bonds.“

Ames continues that when they went out to their network for funding, they got about two-thirds of their development project through people’s retirement funds. “No one knew it existed, and they were excited about the idea of being able to put those funds to work for them in a way that was more active and that they felt a connection to,” he added.

The process was a bit confusing, so when the two set up Guidant Financial, they agreed to create a way to make 401(k) financing easier for people to get their funds in a place where they can invest them in alternative assets.

Finding a Niche with 401(k) For Business Funding

While Guidant originally was focused on real estate-based assets like foreclosure sales and tax liens, Ames and Nilssen quickly learned their niche audience wanted to invest their retirement funds. By hiring an ERISA attorney, they figured out the ins and outs of Rollovers for Small Business Financing (ROBS), or 401(k) business financing. “We started thinking about structuring something that would help customers be able to use retirement funds, and we found out that it’s been done since 1974.“

And 401(k) is not just for wealthy people, as it was believed in the past.

“It’s been a fun ride,” Ames said. “Helping people who maybe didn’t think they had a path to get there but were able to find a path with this asset they can use to invest is exciting.”

ROBS Program: An Overview

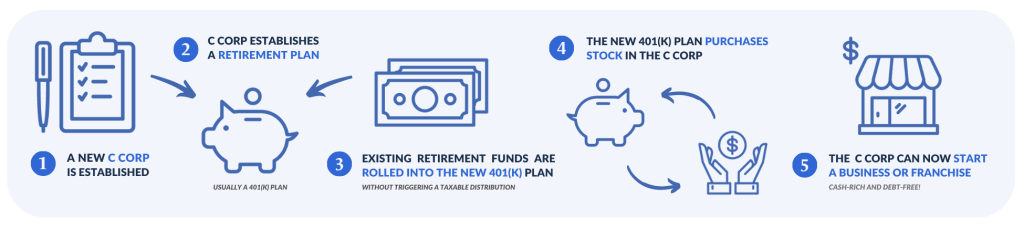

According to Ames, borrowing money from your retirement plan has to be structured in a way where your retirement account is becoming an owner of the business. That’s the first step. (And remember that most retirement plans qualify for the ROBS program – not just 401(k)s!)

Ames notes that some people get confused about that – thinking it’s their 401(k) or retirement plan and they can do with it what they’d like. But the short answer is that you need to ensure your next steps are correct.

This second step is setting up a C Corporation (C Corp) for your business, which is essential to using ROBS. Why? The main reason for this requirement is that C Corps allows “non-human” entities, like your retirement fund, to own shares in the company. Other types of business structures, like S Corporations, only allow actual individuals (human beings) to be shareholders. So, to use ROBS legally, your business has to be a C Corp to accommodate this unique shareholder setup where your retirement fund acts as an owner.

This C Corp then sets up a new retirement plan, typically a 401(k). You can roll your existing retirement funds into this new 401(k). The money in this 401(k) is then used to buy stock in your C Corp. In exchange for the stock, the 401(k) provides cash to the C Corp. The C Corp uses this cash to purchase business assets or cover other business expenses. This way, your retirement funds are invested directly in your business, giving it the capital it needs to operate.

“In many cases, our clients use the cash as a down payment to get a Small Business Association (SBA) loan,” Ames said.

He goes on to say that you can leverage your 401(k) for the entire down payment of a business you’re purchasing, too. He notes that anytime you’re going to use debt in a business you’re upping the risk factor of that business. “Now you have a good portion of the cash flow of the income of that company that’s going to go out the door to the bank regardless of what’s happening in the economic cycle or what’s happening in the business.“

If there’s a downturn, that doesn’t leave a lot of wiggle room.

Instead, Ames is a big advocate of using ROBS – a funding solution with no debt. He notes to remember to get a solid Certified Public Accountant (CPA) who is familiar with ROBS, and to pay yourself a fair market wage.

Want a better understanding of how Rollovers for Business Startups (ROBS) works? Start with the Top 10+ Resources and Guide for Getting Started with ROBS.

Engaging with Guidant

If you’re this far and thinking seriously about 401(k) business financing, Ames says to engage with Guidant sooner rather than later.

“I wouldn’t go shopping for something without knowing what my funding range is going to be. Otherwise, I’m going to get to the negotiating table, and I won’t know my bottom line.“

This is especially true if you’re looking at multiple funding sources and options, such as SBA financing, retirement funds, and unsecured loans.

“In that case, I think you probably want to have your plan as part of the start of your shopping process,” Ames says.

There’s a pre-qualification tool on the Guidant website if you’re ready to get a range of funding before all the details.

As for the process, the biggest variable, according to Ames, is “who is holding your money.”

He says different custodians have different practices in terms of processing and releasing retirement funds. On average, most clients take 30 to 40 days for everything from C Corp filling to the entity being set up to the 401(k) being established and the funds getting rolled over.

As for the time you can spend, you can expect it to vary wildly. SBA loans, for example, take a long time to approve.

With ROBS, time to funding is much shorter but you will need a third-party administrator to file an annual tax return. Guidant does this for over 8,000 customers today. More recently, Guidant also rolled out payroll and bookkeeping business units to help business owners through those tedious – but mandatory – tasks.

Ames says, “You can just do your payroll with us and then we don’t have to chase you for the data; we’re already going to have it.“

In addition to payroll, Guidant also ensures your 401(k) plan stays in compliance with the IRS and DOL through the life of your business, providing audit protection, if needed. In fact, Guidant will pay for competent representation if your account gets audited. Ames adds, “We do it as much for you as for Guidant.“

Explore Chapter 5 of Guidant’s Complete Guide to ROBS to learn how to choose the right ROBS provider for your business.

Finding Financial Freedom

Ames tells a story about an entrepreneur who was so pleased when he was laid off his corporate job because “owning a business can be stressful, but it’s a different type of stress. He has control in his own business now.“

In the end, Ames says the reason Guidant Financial has been around for over two decades is because it cares about people just like this entrepreneur and the small businesses it services.

Ready to learn more about how to use your 401(k) funds to finance a business venture? Pre-qualify today.

“When Falling Sky Brewing presented itself as a great opportunity for me, I needed the capital. Traditional lenders weren’t going to do it. I took a chance on myself that I could grow my business and my 401(k)… And I thought, ‘You know what? I could do this without overhanging debt.‘”

— Stephen Such, Falling Sky Brewing

Read the stories of REAL small business owners who work with Guidant.