Guidant’s annual Small Business Trends report dives into the lives of over a thousand American small business owners, uncovering their top motivations, challenges, the state of their businesses, and beyond. As we approach Election season this year, we’ve also sought the input of business owners when it comes to casting their ballots and assessing their overall confidence in today’s political climate.

Keep reading to discover the latest happenings in the world of small business — from election year insights to the top industry trends to exploring the aftermath of the great resignation.

Explore the full 2024 Small Business Trends study now.

Small Business Trends 2024: Key Findings

Top Industry Trends and Challenges

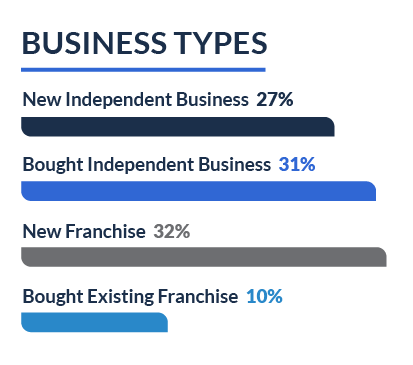

Shift Towards Independence

- Independent businesses have taken center stage, marking a four-percentage point increase compared to the previous year.

- Newly established independent businesses rose from 21 percent to 27 percent.

Top Challenges

- Inflation and price increases have surged to the forefront as a top challenge among small business owners, with 23 percent of respondents naming it their biggest concern.

- Recruitment and retention, which held the top spot last year, have now dropped to second place at 19 percent.

Resilience Amid Economic Challenges

- Despite economic uncertainties, 77 percent of small business owners express confidence in their ability to endure ongoing economic challenges, showcasing the resilience ingrained in the entrepreneurial spirit.

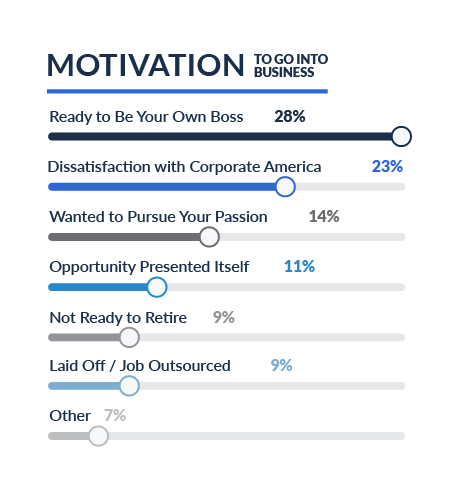

Motivations for Business Ownership

- A majority of respondents went into business ownership because they were ready to be their own boss (28%). Dissatisfaction with corporate America and passion are also primary motivations for entrepreneurship, with 23 percent citing dissatisfaction and 14 percent pursuing their passions.

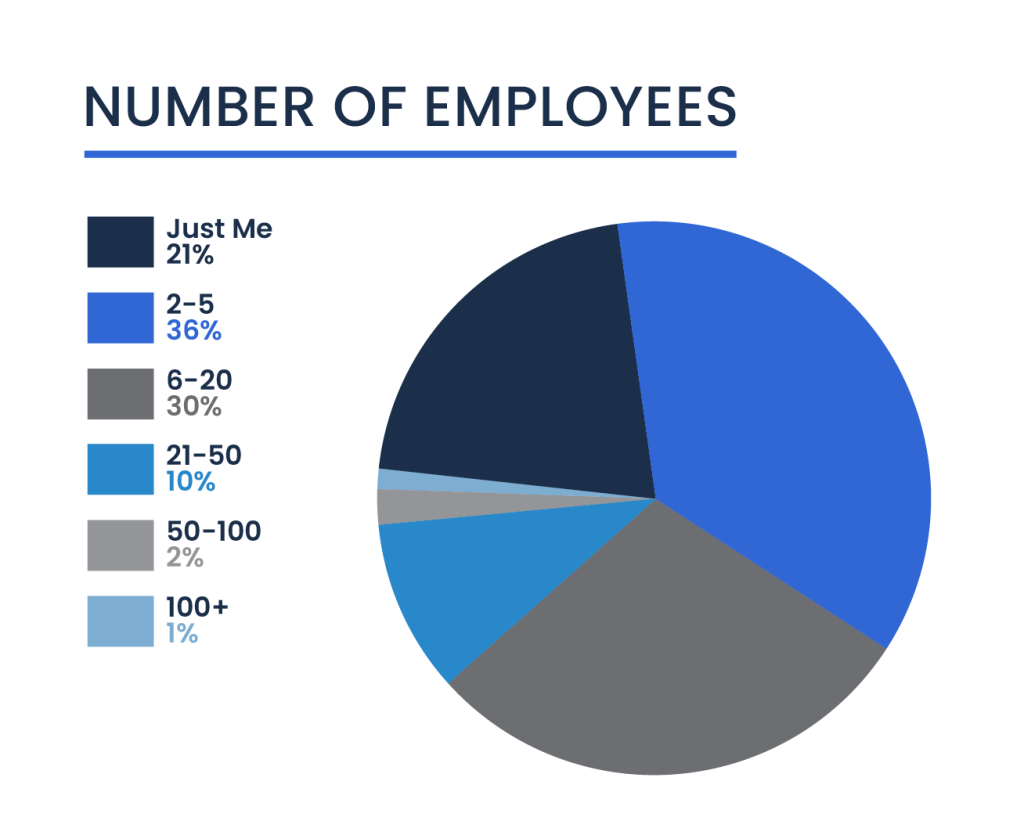

Team Sizes

- A majority (36%) maintain small teams with two to five employees, while 16 percent have slightly larger teams with six to ten individuals.

- 21 percent of respondents are solo entrepreneurs, indicating a rise in individuals running their businesses alone compared to last year.

- There’s a spectrum of business sizes within the small business sector, with respondents managing enterprises ranging from six to 50 employees.

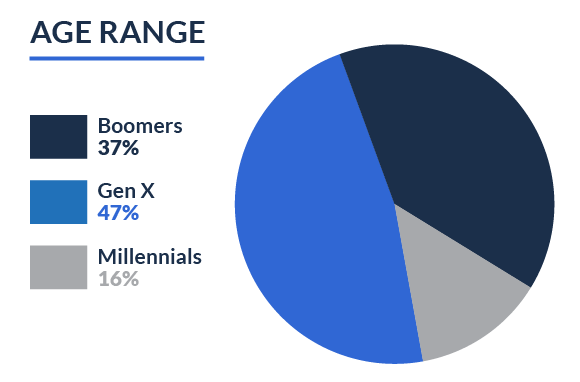

Generational Dynamics, Diversity and Education in Entrepreneurship

Generational Shifts

- Millennial business owners have seen a remarkable 27 percent increase since 2023, beginning to close the generational gap in small business ownership.

- Baby Boomers have experienced a seven percent drop in representation since last year, while Generation X remains a strong presence.

- Despite these shifts, both the Gen X (47%) and Baby Boomer (37%) cohorts continue to lead the way in small business ownership.

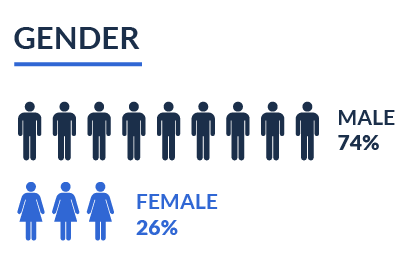

Gender Diversity in Small Business Ownership

- While there’s a three percent growth in women business owners since last year, men still dominate small business ownership, comprising 74 percent of respondents.

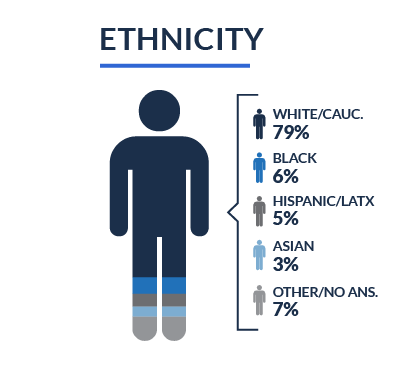

Ethnic and Racial Inclusivity

- The majority of small business owners identify as “White or Caucasian” (79%), indicating a need for greater representation from other ethnic and racial groups.

- There is notable underrepresentation of “Black or African-American” (6%), “Asian or Asian-American” (3%), “Hispanic, Latino, or Spanish Origin” (5%), “Indigenous American, Native Hawaiin or Pacific Islander” (1%), and “Middle Eastern or North African” (1%) individuals in small business ownership.

Educational Attainment

- A significant 85 percent of surveyed business owners hold post-secondary degrees, with 44 percent possessing bachelor’s degrees and 27 percent holding master’s degrees.

- High school graduates, or those with a GED, comprised 15 percent of the group.

Political Landscape

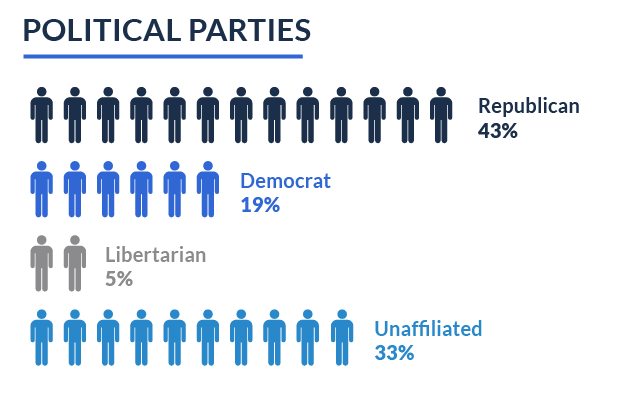

Political Affiliations and Confidence

- 43 percent of small business owners identify as Republicans, while 19 percent identify as Democrats.

- Notably, 33 percent feel unrepresented by any political party. A significant proportion expresses uncertainty or lack of confidence in today’s political landscape.

- This year’s survey indicates that 14 percent of small business owners feel “very unconfident” in the current political landscape, with an additional 32 percent expressing “somewhat unconfident,” highlighting significant political uncertainties among this demographic. Twenty-three percent of respondents remained “neutral.” Conversely, 28 percent expressed feeling “somewhat confident,” reflecting a group with some faith in today’s current political climate, while only five percent reported feeling “very confident.”

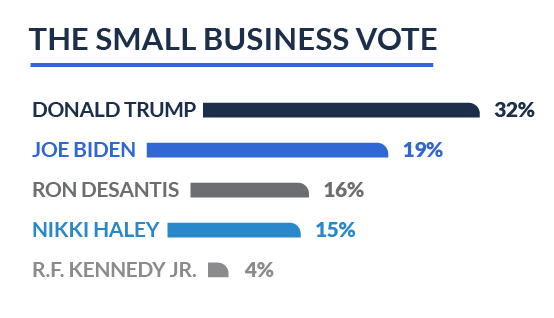

The Small Business Vote

- Among respondents, 32 percent expressed support for Donald Trump, while Joe Biden garnered 19 percent support from surveyed small business owners, indicating a notable difference in backing between the two candidates.

- Ron DeSantis received 16 percent of support, closely followed by Nikki Haley with 15 percent. Vivek Ramaswamy, Robert F. Kennedy Jr., and Chris Christie each received support from around three to four percent of respondents, highlighting diverse opinions among small business owners this election year.

Recruitment Trends

Recruitment and Retention Challenges

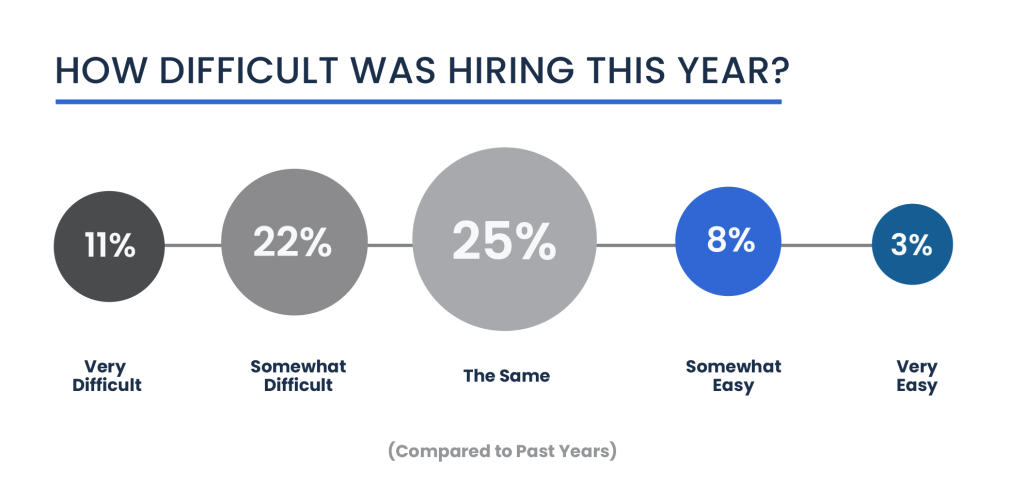

- Recruitment and retention challenges among master’s owners notably decreased this year, with those finding it “very difficult” dropping by 52 percent, and those finding it “somewhat difficult” decreasing by 11 percent compared to previous years.

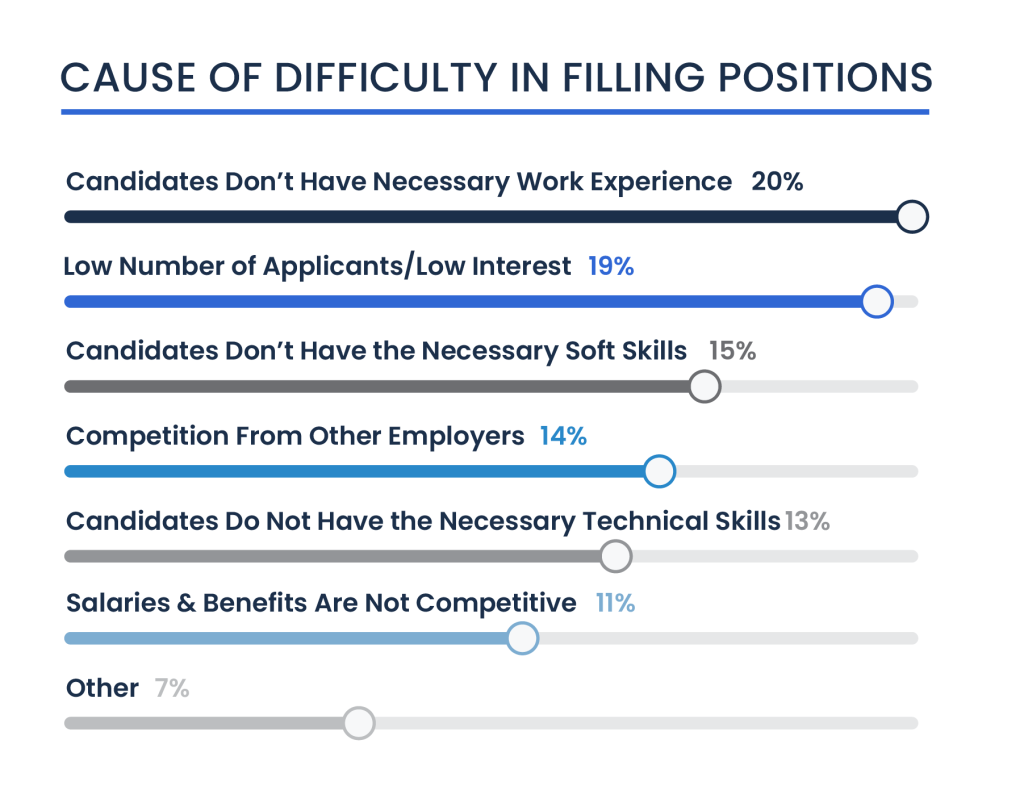

- Challenges persist, including candidates lacking work experience”(20%) and competition from other employers (14%).

Talent Acquisition Shifts

- This year, the primary challenges reported in filling positions were candidates lacking necessary work experience (20%) and a low number of applicants or low interest in the positions (19%).

- Our study showed a 29 percent decrease in issues related to a low number of applicants or lack of interest compared to the previous year, signaling improved recruitment efforts.

Difficult-to-Fill Job Roles

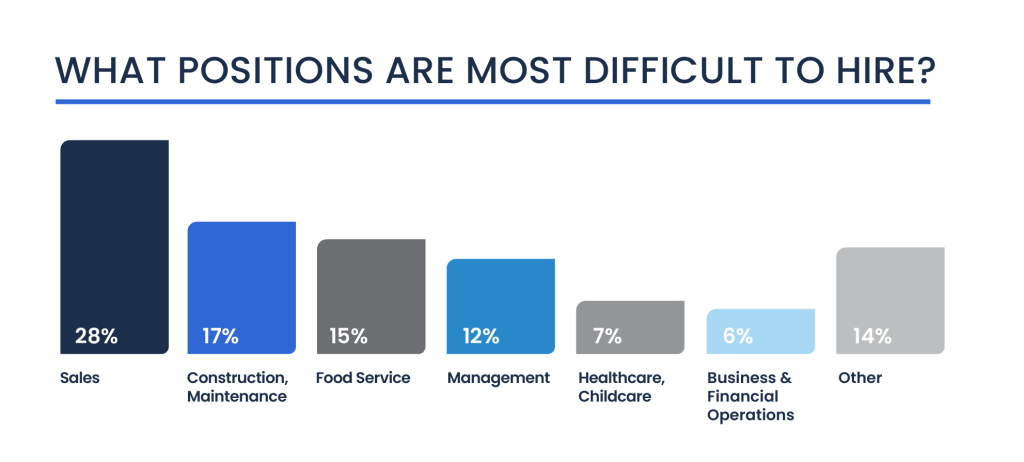

- Sales and related roles are the most challenging to fill, followed by positions in construction/maintenance and food service.

Looking Ahead: 2024 Small Business Trends Summary

As the small business landscape continues to evolve, these trends provide valuable insights into the challenges and opportunities faced by entrepreneurs across the nation. Despite uncertainties, the prevailing sense of resilience and determination among small business owners underscores their crucial role in driving economic growth and innovation.

Can’t get enough of the latest trends in small businesses? Discover more insights into the world of small business in our full 2024 Small Business Trends report.

Turn Your Business Dreams into Reality with Guidant

Have you been dreaming of starting your own small business? We can help make that happen. With our education-focused and people-first approach, Guidant Financial is the go-to provider for small business owners seeking financial freedom and tailored support. Guidant has funded and supported over 30,000 American small businesses to date.

Our team of financial experts provides custom, innovative funding strategies customized to meet your unique business goals and needs. Plus, we can support you throughout the lifetime of your business — offering affordable and reliable Business Services, including Accounting & Tax and Payroll.

Reach out today and discover how Guidant can help take your business dreams to the next level!

Call us today at 425-289-3200 for a free, no-pressure business consultation to get started — or pre-qualify in minutes for business financing now!

“Guidant is our one-stop shop for us to do it all. And I will say that one of the characteristics of Guidant that I really appreciate is the commitment to service and getting it right.”

— Tom Gonzalez, Woof Academy

Read the stories of REAL small business owners who work with Guidant.