New small business owners are increasingly likely to launch their businesses while still working for another organization. In 2023, 44 percent of new entrepreneurs were also working at another job, a dramatic rise from the 29 percent who did so just a year earlier. It’s a way of establishing a new business while benefiting from the stability of a job and salary.

If you’re one of these new or aspiring small business owners, it can help you to know about in service rollovers. Frankly, it’s a term and concept many people haven’t heard about. It can increase your retirement investment options while helping you with small business management, funding, and strategy. Both are potentially important benefits for small business owners.

What Is an In Service Rollover?

In service rollovers are transfers of the funds in an employer-sponsored retirement plan while you are still working at the company that offers it. (The latter is why they are called “in service” – you’re still in service, as opposed to a transfer of the employer plan after you’ve left the company.) They can be used to fund a new business or transferred into another retirement account, such as an Individual Retirement Account (IRA).

“Rollover” means that you are transferring the employer-sponsored plan funds within a period and using a method that ensures the transferred funds won’t be taxed. Withdrawn retirement assets are subject to tax and penalties by the Internal Revenue Service (IRS) unless rolled over properly. Taxes and penalties can significantly reduce retirement funds. It also lessens the investment returns you may have earned had your funds not been reduced by taxation and stayed invested.

Advantages of Doing as In Service Rollover

Why would you want to do an in service rollover?

First, in service rollovers from a 401(k) offer you a much wider range of investment options. Most company-sponsored 401(k) retirement plans offer a limited number of investment choices. The average is three stock funds and three bond funds, but because many companies split the choices between domestic and international, you may wind up only having one or two choices in the country or sectors you’d prefer.

With a self-directed IRA, however, the choice is very broad. It’s up to you, not your company. You can buy mutual funds, exchange-traded funds (ETFs), individual stocks, bonds or cash. If you want to purchase funds specializing in specific sectors, such as real estate, you can.

Second, an in service 401(k) rollover gives you much more control over your retirement assets. You may have already thought of your retirement funds as a potential source of money to fund your business, for example.

But retirement funds are not accessible without taxation and tax penalties, of course. If you are below the age of 59½, the IRS will fine you a 10 percent early withdrawal penalty right off the bat. Withdrawals from a traditional 401(k) will also be taxed at your current tax rate, at any age. The end result is that the money you receive can be considerably less than you withdraw. But if the money is rolled over within the required time period and in a proper way, the money will not be taxed at all. A rollover allows penalty-free withdrawals.

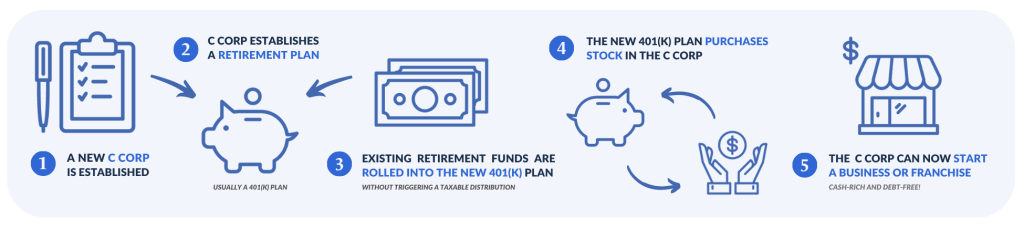

This strategy is called Rollovers for Business Startups (ROBS), which is a method of withdrawing retirement funds without incurring taxes on them. To use ROBS, your company needs to be a C Corporation with a retirement plan such as a 401(k) open to all employees, including yourself. (Note: Even though ROBS is also known as “401(k) business financing,” most popular retirement plans qualify. See a full list here.)

A ROBS transaction consists of rolling over your withdrawn retirement funds into the new retirement plan. Those funds are then used to buy stock in your company. After that, you can use the funds for any business purpose. In other words, doing an in service rollover and then using ROBS to obtain funding can completely avoid taxes and penalties on your rolled-over funds.

ROBS can also utilize IRA funds. If you want to use your in service rollover to gain a wider choice of investment options with the ability to use the IRA funds in ROBS at a later point, you can.

Third, an in service rollover can lower the administrative fees you’re charged for having retirement funds with your current employer.

Company-sponsored plans are subject to administrative and investment fees. This varies from plan to plan, but some can be comparatively high, which can erode your investment amounts over time.

Disadvantages of an In Service Rollover

Small business owners also need to understand some potential disadvantages of an in service rollover, though. First, the administrative fees could be higher – you would have to research your existing administrative fees and the fees of any self-directed IRA you are considering to see the comparative costs. You may also be charged management and advisory fees, making IRAs as costly as some 401(k) plans.

Second, some 401(k)s offer advantages such as taking a loan or starting withdrawals at age 55 under certain conditions. IRAs do not offer these benefits.

Third, some companies who approve an in service rollover may impose restrictions on when you can resume contributions to the 401(k). There may be delays in your ability to contribute.

How To Do an In Service Rollover

The in service rollover process must be done according to specific requirements, or you’ll owe taxes and penalties.

Remember, not all companies allow in service rollovers. You’ll need to check that yours does. Second, your company may impose requirements, such as having held the funds for three to five years or being over the age of 55.

In all cases, you will need to be vested in the funds you want to withdraw.

Now, on to actually starting and completing the rollover! You can use any of the available methods:

- A direct rollover – You can formally request that the 401(k) plan administrator roll the funds you’ve requested directly over to your new tax-advantaged account. (Note that you must open the new account first.) They can make out a check and send it directly.

No taxes are withheld from a direct rollover and you don’t have to worry about the timeline or deadline in which it needs to be done, because the plan administrator takes care of it. - An indirect rollover – If you want the withdrawn funds paid to you, you must deposit it yourself into an IRA or another tax-advantaged retirement plan within 60 days. (This method if sometimes known as a 60-day rollover.) If the deposit into a new qualified fund isn’t completed within that period, you’ll be assessed taxes and penalties.

Note that the IRS requires companies to withhold 20 percent tax from any 401(k) distribution made to you. In other words, if you withdraw $50,000 in an indirect rollover, you’ll receive $40,000, because $10,000 will be withheld for taxes.

Get the breakdown of how 401(k) business financing – also known as Rollovers for Business Startups (ROBS) – here.

Advantages of Using In Service Rollovers for Funding Your New Business

You can use your in service rollover to finance your new small business by rolling it over into the new business’s retirement plan in a ROBS transaction or later using the IRA you establish.

Many small business owners think of securing a loan when they think of funding. But ROBS funding has multiple advantages over a loan for small business owners, such as:

- No debt service payments. You begin the business debt-free. Debt service can sap your cash flow, especially in the startup stages. ROBS allows you to start the business cash-free and without debt.

- No need for credit checks. Lenders require strong credit scores. You can be turned down for a loan if you don’t have the credit score they are looking for.

- No need for down payments or collateral. Lenders also require down payments of up to 20 percent of the amount requested. Depending on your financial history, they may also require substantial collateral, including assets such as your house. Aspiring and beginning small business owners may find the down payment and collateral mandates challenging. ROBS removes the need for them.

Finally, ROBS offers great flexibility in financing, because if you do want to obtain a small business loan, ROBS can be used as the down payment or combined with a loan for maximum financing amounts.

Ultimately, in service rollovers and ROBS can be strategic tools to widen your investment options and let you begin and grow a small business while remaining employed.

Learn more about using this innovative funding strategy in Harnessing ROBS While Working: Why It Makes Sense and How to Do It Right.

Guidant Financial Helps Aspiring Small Business Owners

Thinking about exploring using your retirement funds to start a business?

Guidant Financial, America’s No. 1 ROBS provider, can help. Guidant has powered the dreams of over 30,000 small business owners across the U.S., helping them secure the funding they need through ROBS (Rollovers for Business Startups) and small business loans. Navigating ROBS can be complex, but we’re here to make sure the process is simple.

Beyond just funding, we also offer a range of business services, freeing you to focus on what you do best – running your business.

Ready to see if ROBS is the right fit for you? Reach out today and let’s discuss your business’s future.

Call us today at 425-289-3200 for a free, no-pressure business consultation to get started — or pre-qualify in minutes for business financing now!

“When Falling Sky Brewing presented itself as a great opportunity for me, I needed the capital. Traditional lenders weren’t going to do it. I took a chance on myself that I could grow my business and my 401(k)… And I thought, ‘You know what? I could do this without overhanging debt.‘”

— Stephen Such, Falling Sky Brewing

Read the stories of REAL small business owners who work with Guidant.