2024 Small Business Franchise Trends

A look at the state of franchises in 2024

Each year, Guidant Financial explores the intricate tapestry of American business ownership, capturing the core motivations, hurdles, and industry shifts in our Small Business Trends report. Our latest survey reveals a standout trend: the growing appeal of franchising.

Franchising has been a steadily popular option for business owners, with over 42 percent of respondents choosing to open or acquire franchise units this year.

Many entrepreneurs see franchising as a safer option, thanks to its established business model and support from the corporate side. This makes it particularly attractive during uncertain economic times.

Let’s dive into the latest trends shaping the world of franchising in 2024, exploring franchisees’ economic outlook, challenges, political preferences, and more in our 2024 Franchise Trends study.

What are Small Business Franchises Like in 2024?

New or Existing?

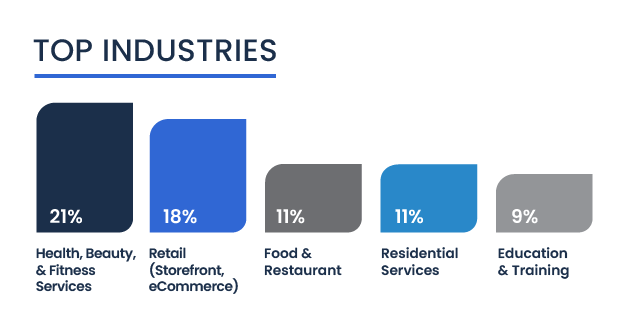

Top Franchise Industries

Our study unveils a diverse spectrum of franchise industries, each catering to distinct consumer needs and market segments. A significant portion, comprising 21 percent, represents franchises in the Health, Beauty, and Fitness sector, reflecting a growing emphasis on wellness and personal care services. Following closely behind, at 18 percent, are franchises within the Retail industry, showcasing the enduring appeal of brick-and-mortar commerce in an increasingly digital age. Meanwhile, Food and Restaurant franchises make up 11 percent of the market, highlighting the timeless popularity of dining and culinary experiences.

Additionally, Residential and Commercial Services franchises also constitute 11 percent, indicating a robust demand for essential maintenance and property management solutions. Finally, the Education and Training sector commands nine percent, underscoring consumers’ enduring pursuit of knowledge and skill enhancement. Together, these diverse industries paint a rich landscape of franchise opportunities, from personal well-being to professional development and beyond.

Profitability and Growth

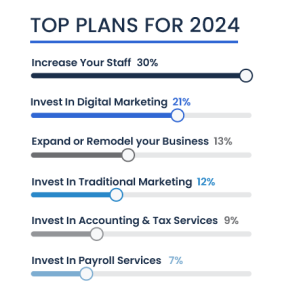

In terms of strategic initiatives, franchisees are looking to invest in various areas to fuel growth and competitiveness. Thirty percent plan to bolster their workforce by increasing staff. Meanwhile, 21 percent intend to prioritize digital marketing efforts, recognizing the importance of online presence and engagement in today’s digital-centric marketplace.

In addition, 13 percent plan to undertake remodeling or expansion projects to modernize and improve their business premises, while 12 percent aim to invest in traditional marketing channels to reach wider audiences. Nine percent of franchisees are considering investments in accounting and tax services, underscoring the importance of financial management and compliance in sustaining and growing their ventures.

Franchise Financing Trends

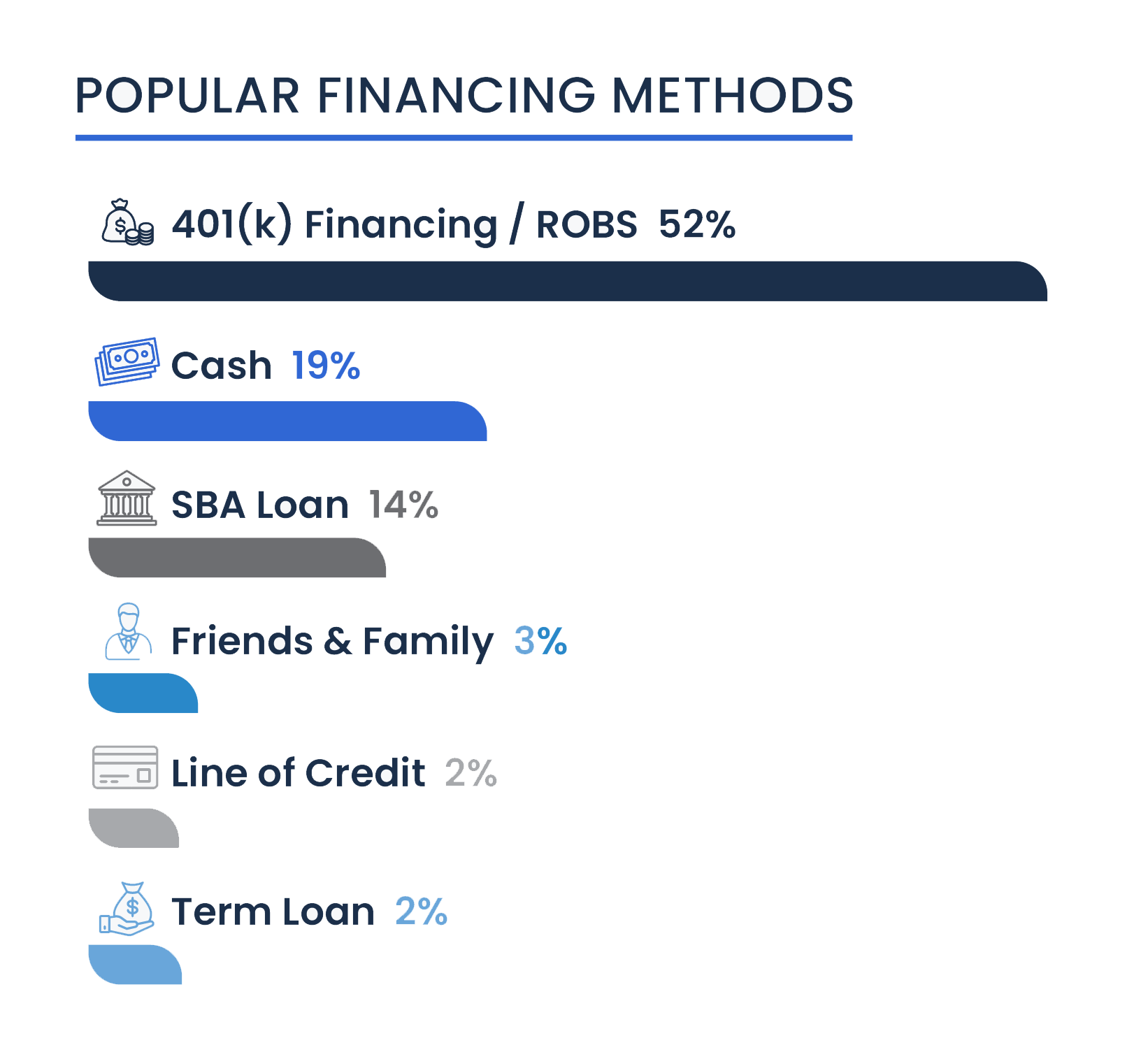

Additionally, cash remains a popular choice, with 19 percent of franchisees utilizing personal savings or liquid assets to fund their ventures.

SBA loans also play a significant role, with 14 percent of franchisees securing financing through this government-backed program. SBA loans provide entrepreneurs with access to capital at favorable terms, facilitating business growth and expansion.

A smaller percentage of franchisees, comprising three percent, rely on support from friends and family to finance their ventures.

Furthermore, equipment leasing emerges as another financing avenue, albeit less commonly utilized, with three percent of franchisees opting for this method.

Overall, while ROBS emerges as the primary financing choice for most franchisees within our clientele, the diverse array of funding options showcases entrepreneurs’ adaptability and resourcefulness in navigating the financial landscape of franchise ownership.

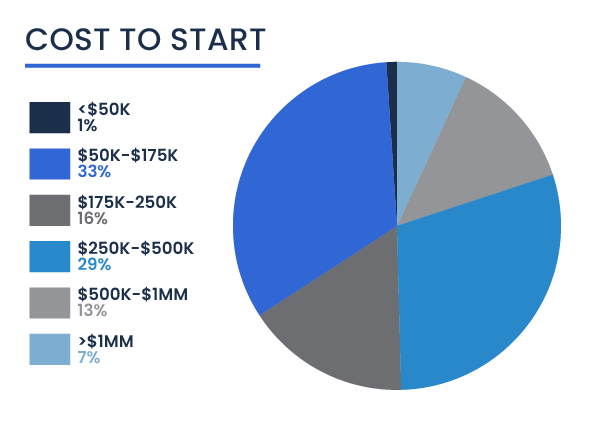

Cost to Launch

In addition, 15 percent of respondents reported startup costs between $50,000 and $100,000, indicating a notable portion of franchisees with relatively lower initial financial requirements. Conversely, 15 percent of franchisees reported higher startup costs falling within the range of $375,001 to $500,000, signaling an increased investment for those pursuing larger-scale franchise opportunities.

Furthermore, 13 percent of franchisees reported even higher startup costs ranging from $500,001 to $1 million, highlighting the varying financial commitment required for specific premium franchise opportunities or multi-unit ventures.

Recruitment and Retention Trends

Hiring Difficulty

Navigating the hiring landscape poses various challenges for small business owners, as revealed by our study’s data. Eleven percent of respondents reported finding hiring “very difficult,” while a larger portion, comprising 24 percent, expressed that it was “somewhat difficult.” Interestingly, 26 percent indicated their hiring experiences were consistent with previous years, while a smaller percentage — totaling 11 percent — found hiring “somewhat easier” compared to previous years.

It’s worth noting that four percent of respondents reported finding hiring “very easy” compared to other years. On the contrary, a significant portion, representing 24 percent of respondents, reported not engaging in any hiring during the surveyed period.

Moreover, it’s significant to highlight that we’ve observed a 54 percent decrease in business owners who report hiring being “very difficult” compared to last year’s study. This suggests a notable shift in the hiring landscape, potentially indicating improvements or adaptations made by small business owners in response to evolving market conditions.

Gaps in Candidates

Additionally, the data reveals challenges in other sectors as well. Ten percent of franchisees reported difficulties in filling positions within the food service sector. Management roles also presented hurdles, with 13 percent of franchisees reporting gaps in candidates for leadership positions.

Furthermore, the construction, maintenance, installation, and production sectors faced challenges, with 14 percent of franchisees encountering gaps in candidates for these roles. Similarly, healthcare, childcare, and service sectors experienced shortages, with 13 percent of franchisees struggling to find suitable candidates to fill positions in these service-oriented fields.

Future Plans for Overcoming Hiring Challenges

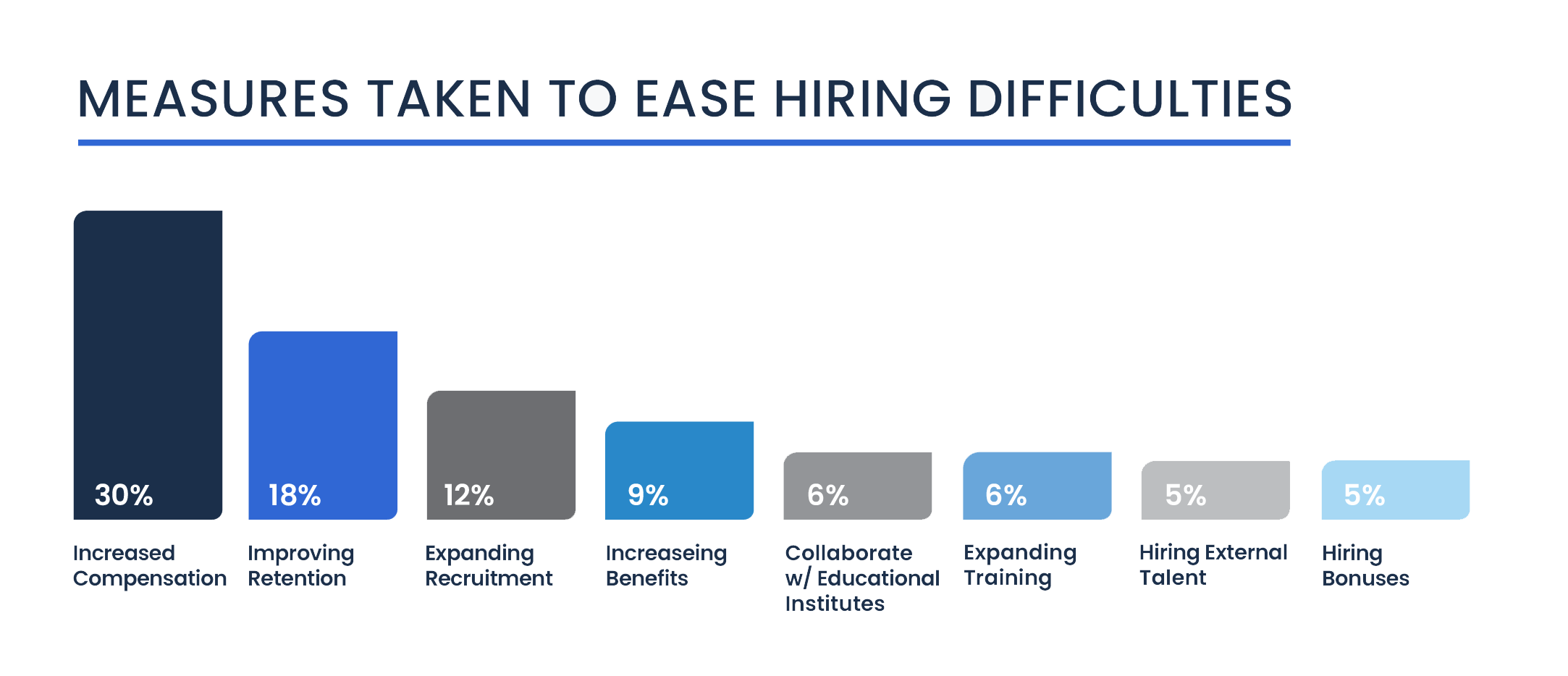

Franchisees are proactively strategizing to address the persistent recruitment and retention challenges identified in our survey. Thirty percent of respondents plan to increase compensation, recognizing the importance of offering competitive pay rates to attract and retain top talent in today’s competitive labor market.

Additionally, 18 percent of franchisees are focusing on improving retention efforts, understanding the value of retaining existing employees amidst difficulties in hiring new ones. This highlights a shift toward prioritizing employee satisfaction and engagement to mitigate turnover and talent shortages.

Expanding recruitment advertising efforts emerged as another key strategy, with 12 percent of franchisees intending to invest in broader recruitment advertising campaigns to reach a larger pool of potential candidates.

Moreover, nine percent of respondents plan to increase benefits as part of their future hiring strategy, recognizing the role of comprehensive benefits packages in attracting and retaining skilled employees.

These future plans underscore a proactive approach among franchisees to address hiring challenges, focusing on a combination of competitive compensation, retention initiatives, recruitment advertising, and enhanced benefits to secure a talented workforce and drive business success.

Who are Franchise Owners in 2024?

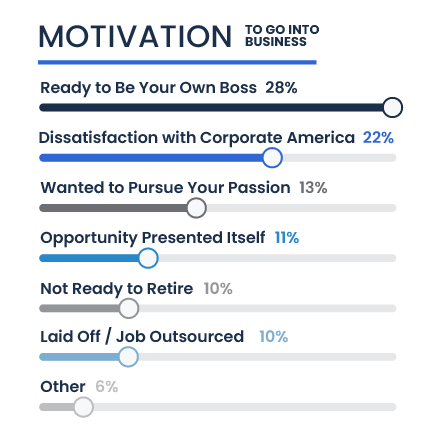

Motivations

Additionally, 13 percent were driven by passion, aligning personal interests with professional pursuits. Another 11 percent seized compelling opportunities, emphasizing the role of timing and circumstance. Furthermore, ten percent delayed retirement to remain engaged in meaningful work, while another 10 percent turned job loss into entrepreneurial opportunity.

These varied motivations highlight the unique aspirations driving franchise ownership today.

Generational Differences

Diversity in Franchising

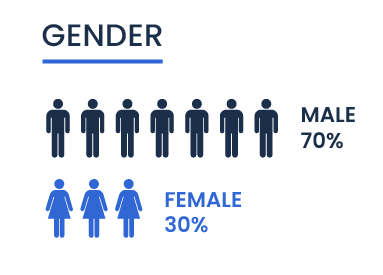

In terms of gender diversity, our data shows that 70 percent of franchisees are male, while 30 percent are female. Interestingly, women are more likely to go into franchising.

In fact, the share of women in franchises is notably higher, with female representation 17 percent greater than observed in the main study — indicating a promising trend toward greater gender inclusivity within the franchise industry.

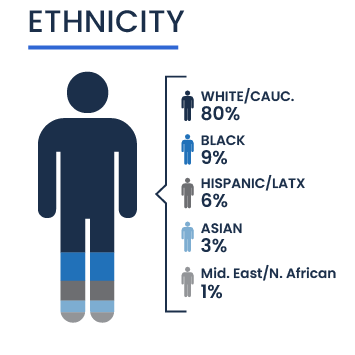

Furthermore, our study sheds light on the racial and ethnic composition of franchise ownership. The majority of franchisees, comprising 80 percent, identify as White or Caucasian.

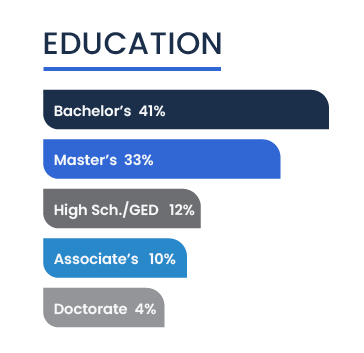

Education Levels

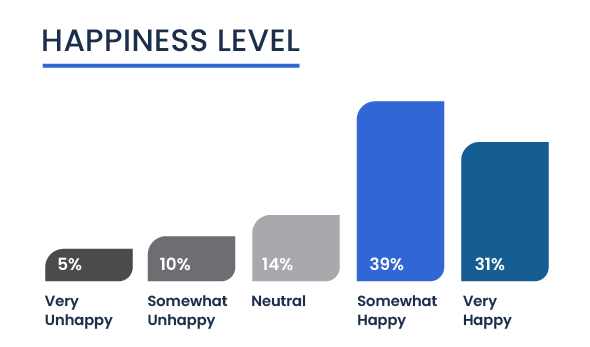

Measuring Happiness Levels

Top Franchising States

By exploring franchise ownership distribution across various states, we unveil the geographical landscape of franchising within the U.S.

Texas emerges as the leading state for franchising, with 12 percent of franchisees surveyed hailing from the Lone Star State. Florida and California are closely behind, each accounting for eight percent of franchise ownership.

Additionally, Georgia boasts a five percent share of franchisees, while North Carolina, Ohio, and Pennsylvania each represent four percent of franchise ownership.

Economic Impact

Economic Outlook

Economic Confidence

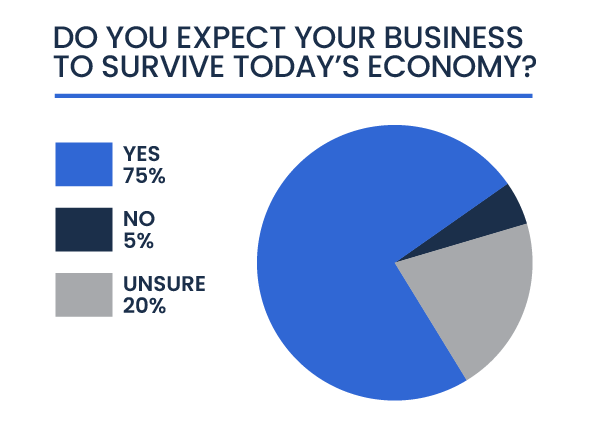

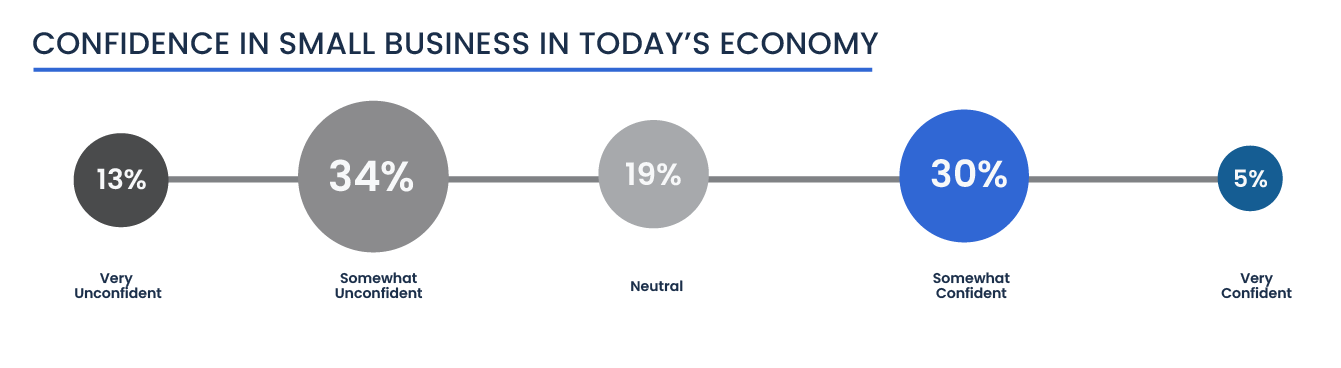

Thirty percent of franchisees express feeling somewhat confident about the economy, while five percent report feeling very confident. Nineteen percent indicate a neutral stance regarding economic confidence. On the other hand, 34 percent of franchisees express feeling somewhat unconfident, with 13 percent indicating a very unconfident outlook.

These findings highlight diverse attitudes and perceptions regarding economic confidence within the franchise community. While a notable portion of franchise owners express varying degrees of confidence in the economy, a significant proportion also harbor uncertainties or pessimistic views.

Impact Factors

According to our study, 29 percent of franchisees have increased prices as a direct consequence of the prevailing economic conditions. Additionally, 16 percent report a loss of revenue, reflecting the challenges posed by economic downturns on business profitability. Moreover, 14 percent of franchisees have encountered the need to raise wages in response to economic pressures, reflecting the broader labor market dynamics and the imperative to attract and retain talent. Furthermore, eight percent of franchisees have resorted to cutting their own wages as a measure to navigate economic uncertainties and sustain their businesses.

These findings show the multifaceted impact of economic conditions on franchise operations, with rising prices, revenue challenges, wage pressures, and personal financial adjustments among the key consequences faced by franchisees.

Top Challenges in Franchising

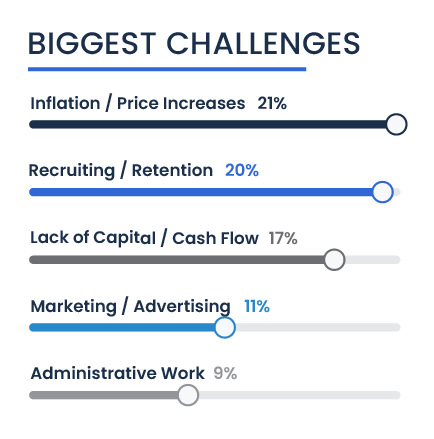

Franchise owners grappled with a myriad of challenges in 2024, reflecting the dynamic economic and business landscape. At the forefront, 21 percent of franchisees cited inflation and price increases as a significant hurdle, highlighting the strain rising costs put on operational expenses and profit margins. Additionally, 17 percent identified a lack of capital and cash flow as a pressing concern.

Recruiting and retention also emerge as another prominent challenge, with 20 percent of franchisees facing difficulties attracting and retaining talent amidst competitive labor market conditions.

Moreover, 11 percent of franchisees struggle with marketing and advertising, emphasizing the need for effective promotional strategies to enhance brand visibility and customer engagement. Furthermore, nine percent cite administrative tasks such as bookkeeping and payroll as burdensome, diverting time and resources away from core business activities.

In a positive development, our study reveals a significant 19 percent decrease in franchisees encountering challenges with recruitment and retention compared to last year. This trend signals an improvement in recruitment and retention efforts among franchise business owners, reflecting proactive strategies and initiatives to address labor market challenges and foster a supportive work environment.

As franchisees continue to navigate these top challenges, forward-thinking solutions and adaptability will be essential in overcoming obstacles and driving sustainable growth in the franchising sector.

Political Outlook Among Franchise Owners

Political Affiliation

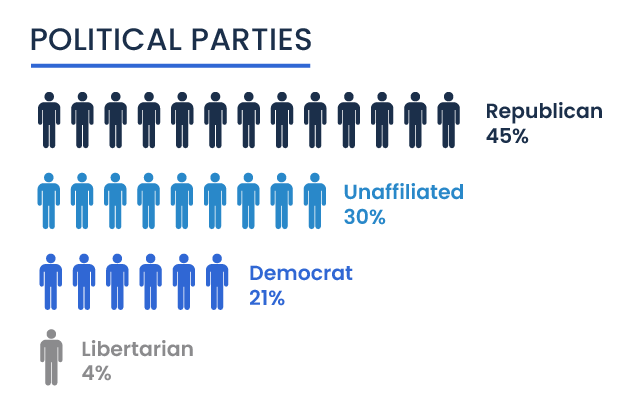

Thirty percent of franchisees report being unaffiliated with any political party, reflecting a significant portion of franchise owners who choose to remain independent of partisan ties. In addition, four percent of franchisees identify with the Libertarian Party, representing a smaller segment within the franchise community.

These findings highlight the varied political affiliations among franchisees, showcasing the diversity of perspectives and viewpoints within the franchise industry.

Political Confidence and Preferences

Thirty-one percent of franchisees express feeling somewhat confident in the political landscape, while four percent report feeling very confident. Additionally, 20 percent indicate a neutral stance regarding political confidence — while 32 percent feel somewhat unconfident, and 13 percent feel very unconfident.

In terms of government support for small businesses, a significant 73 percent of franchisees believe that the government should put more effort into supporting small businesses, highlighting the importance of policy measures and initiatives to bolster the small business sector. Conversely, 11 percent feel that the government shouldn’t prioritize support for small businesses, while 16 percent remain unsure about their stance.

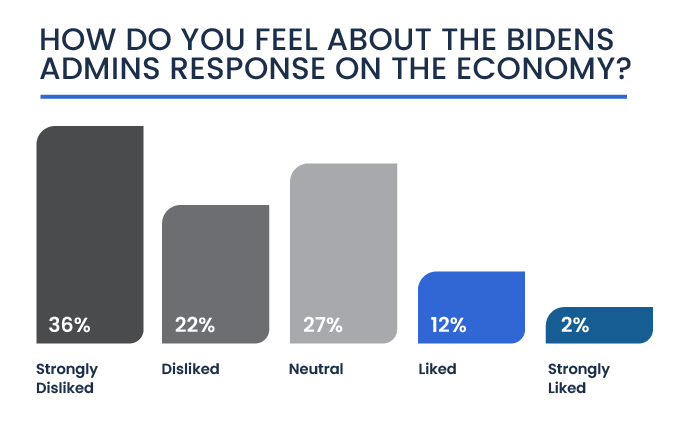

Regarding the Biden Administration’s response, opinions among franchisees are varied. Approximately 36 percent strongly disliked the Biden Administration’s response, with an additional 22 percent expressing dislike alone. On the other hand, 12 percent liked the administration’s response, while only two percent strongly liked it. A significant 27 percent of franchisees report feeling neutral about the Biden Administration’s response.

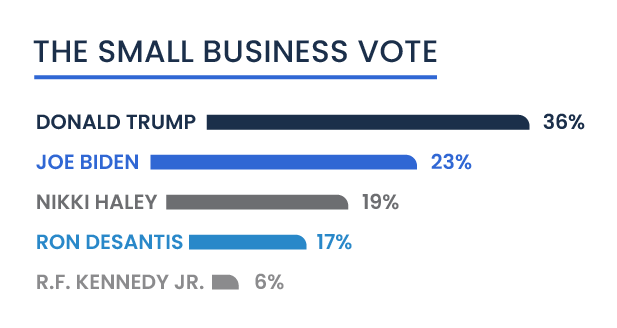

The Franchise Small Business Vote

Resilience and Optimism in Franchising

In summary, our comprehensive study on franchise trends has provided invaluable insights into various aspects of franchising. We’ve explored top franchise industries, recruitment and retention trends, demographics of franchisees, economic impacts on franchise small businesses, the political outlook among franchise owners, and more.

Despite facing numerous challenges, our findings indicate that franchisees are predominantly happy and are actively embracing economic challenges head-on.

Our study also revealed a diverse range of political affiliations among franchise owners, with differing sentiments toward government support and administration responses. While the majority of franchisees believe that the government should put more effort into supporting small businesses, opinions regarding political leadership vary — reflecting the nuanced perspectives within the franchise community.

Overall, the 2024 Franchise Trends survey showcases the dynamic nature of the franchise industry and the proactive approach franchisees adopt in overcoming obstacles and driving growth. It highlights franchisees’ resilience and adaptability amidst economic adversity and political uncertainty.

Trending

Your new life is right around the corner.

Together, we can get your business off the ground — no matter where you are in the small business process.