People of Color Entrepreneurs – 2021 Trends

A look at small businesses owned by People of Color in 2021

Business Owners of Color 2021

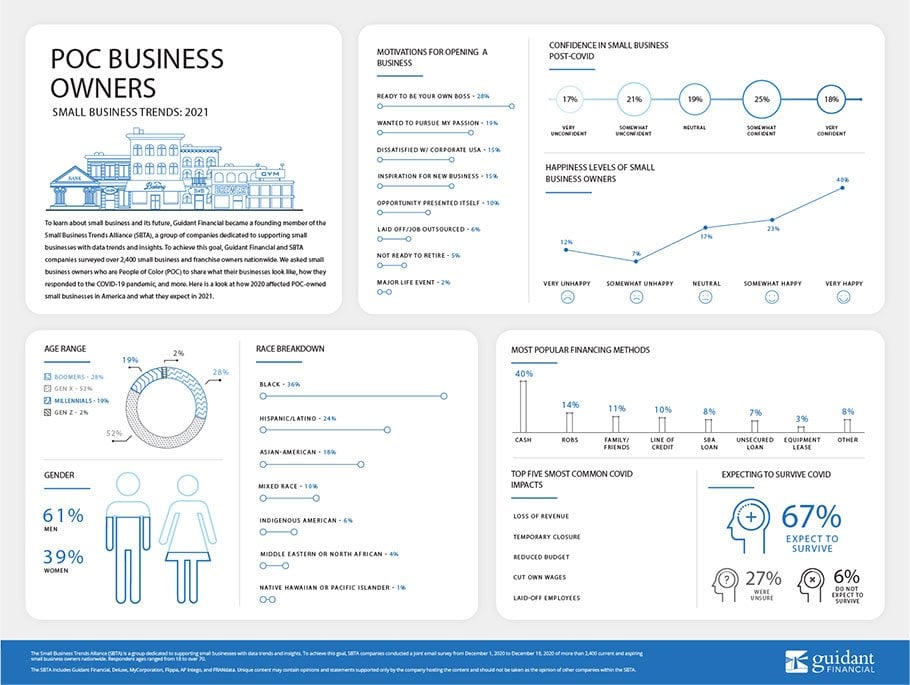

Each year, Guidant Financial and the Small Business Trends Alliance (SBTA) surveys business owners to learn about small business trends and life as a small business owner. A founding member of the SBTA, Guidant Financial is proud to be part of this group of companies dedicated to supporting small business in America with data trends and insights. The SBTA reports on data to help small business owners grow their businesses as well as bring transparency to small business ownership by giving prospective business owners the information they need to be successful.

This year, Guidant and the SBTA surveyed over 2,400 current and aspiring small business owners nationwide with our annual Small Business Trends survey. We asked small business owners who are People of Color (POC) about their experiences throughout the COVID-19 pandemic to their confidence in business given the current political landscape to their biggest obstacles as business owners.

Here’s a look at current POC-owned small business trends and what to expect in the coming year.

Who are POC Entrepreneurs in America?

Small business ownership in America is more diverse than the population by race across the country, based on results from the 2021 Small Business Trends survey compared to the 2019 US Census. Thirty-six percent of survey respondents identified as Black, while the US Census showed 13 percent of Americans as Black or African-American. Twenty-four percent responded as identifying as Hispanic or Latino, while the US Census reported 18 percent of Americans identify as Hispanic or Latino. Eighteen percent of respondents identified as Asian-American, six percent as Indigenous American, four percent as Middle Eastern or North African, and one percent identified as Native Hawaiian or Pacific Islander. About ten percent of respondents identified as mixed race.

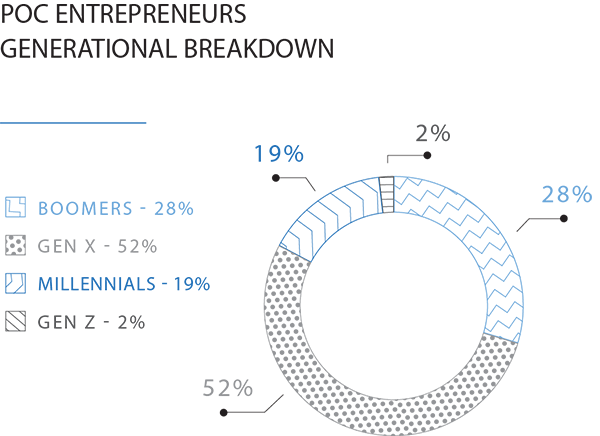

POC small business owners skew younger than their white counterparts. While 46 percent of white small business owners are boomers (born between 1946-64), only 28 percent of POC small business owners fit this generation. The most popular demographic for POC small business owners is Gen X (born between 1965-80) at 52 percent, compared to the 43 percent of white Gen X small business owners. Millennials (born between 1981-96) make up a further 19 percent of POC small business owners, while only two percent are Gen Z (born after 1997). Comparatively, only 11 percent of white small business owners are Millennials, and under one percent are Gen Z, according to survey results.

In a potential relation to the age of their owners, POC-owned small businesses have also been opened for shorter periods of time than many white-owned businesses. Twenty six percent of small businesses surveyed have only been open for a year or less, compared to the 17 percent of white-owned businesses. Thirty-three percent of white-owned businesses have been opened for a decade or longer, while 24 percent of POC-owned businesses have been in operation for ten plus years. Over double the percent of POC small businesses surveyed haven’t opened their doors yet than white-owned businesses (seven percent versus 3 percent).

Comparing POC and white survey respondents shows a higher percentage of Women of Color (WOC) in small business, with 39 percent of POC identifying as women versus 30 percent. Both percentages have increased year over year.

Learn more about Women in Small Business.

The top reasons that POC entrepreneurs started their small business was readiness to be their own boss (28 percent), pursue their own passion (19 percent), and dissatisfaction with corporate America (15 percent) – the same top reasons seen within responses from white entrepreneurs. However, the biggest difference between the two groups was getting into business because of the inspiration for a new business idea: this was the reason for 15 percent of POC entrepreneurs to start their businesses, but only seven percent of white small business owners.

Black Entrepreneurs in America

The largest subset of POC small business owners in America, Black entrepreneurs are an essential part of our small business economy.

The COVID pandemic has affected Black small business even more than many others, due to Black businesses being concentrated in hard-hit service industries, as well as the struggles Black businesses have with equitably receiving funding and financial aid. The Small Business Trends survey saw these challenges reflected in the difference between survival expectations between the average of small business owners and Black small business owners: 77 percent more Black business owners expect their businesses won’t survive the pandemic than the average of small business owners.

Here are more trends among today’s Black small business owners.

- Women make up 46 percent of Black entrepreneurs, one of the highest percentages of female small business owners of any segment.

- The plurality (33 percent) of surveyed Black small business owners had Bachelor’s degrees. The next most common level of education was Master’s degrees, at 26 percent.

- 36 percent of Black entrepreneurs opened their business because they were ready to become their own boss. Twenty-four percent wanted to pursue their passion, 17 percent were inspired with a new business idea, and 17 percent were dissatisfied with corporate America.

- The plurality (42 percent) of Black entrepreneurs are very happy as small business owners.

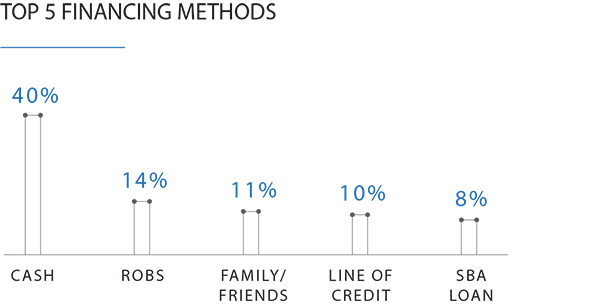

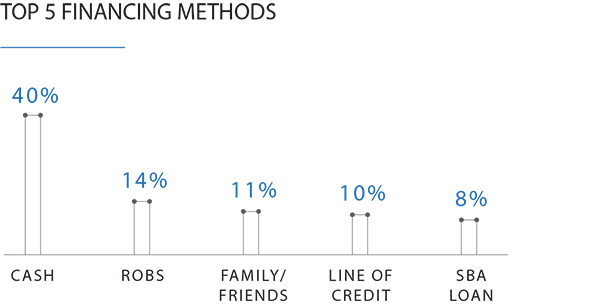

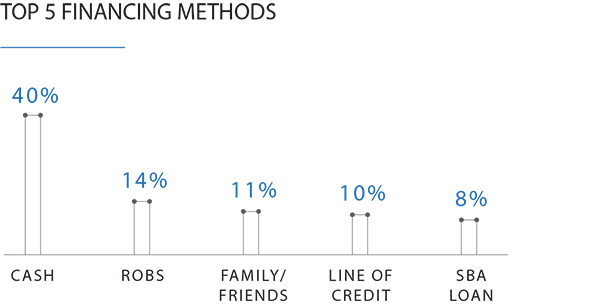

- 43 percent of Black small business owners used cash alone or with another funding option to start their small business.

- 59 percent of Black small businesses required $50,000 or less to start up.

- 77 percent of Black entrepreneurs started their own new independent business as opposed to starting or buying a franchise location or buying an existing small business.

- 54 percent of surveyed Black-owned small businesses were profitable.

- 38 percent of Black small business owners said a lack of capital/cash flow was one of their biggest struggles in the last 12 months.

- 55 percent of Black small business owners want to grow their business as opposed to sustaining, opening a new location, or selling.

- 44 percent of Black-owned businesses have only two to five employees. 36 percent are solo ventures.

- 24 percent of surveyed small businesses lost revenue due to COVID-19. 12 percent temporarily closed.

- 53 percent of Black-owned small businesses did not receive financial aid via the Paycheck Protection Program (PPP) or Economic Injury Disaster Loan (EIDL).

- 41 percent of Black small business owners strongly disliked the US government’s response to COVID-19.

- On average, Black small business owners are neutral in their level of confidence about small business in the political climate.

- 41 percent of surveyed Black small business owners said they didn’t belong to or feel represented by any US political party. 40 percent said Democrat, while 13 percent said Republican.

POC Small Business Owners, COVID-19, and the American Government

Multiple studies have shown small businesses owned by POC have struggled more than white entrepreneurs during the COVID-19 pandemic, especially Black small businesses. Results of the Small Business Trends survey delved deeper into how these struggles vary between groups and how POC entrepreneurs are turning to creative and innovative methods to survive.

The top five most common effects on POC-owned small businesses were loss of revenue (25 percent), temporary business closure (12 percent), reduced budget (11 percent), owner wage cuts (nine percent), and employee lay-offs (six percent.) Only 53 percent of POC-owned small businesses are currently profitable, compared to 65 percent of white-owned businesses.

Despite the difficult situations presented by the COVID pandemic, the majority of POC small business owners surveyed expect their businesses to survive through the coronavirus, at 67 percent.* Six percent don’t expect to survive, while 27 percent remain unsure. However, these expectations differ significantly between POC and white small business owners. Eighty-one percent of white small business owners expect their business to survive the pandemic, while only 3 percent expect to fail, and 16 percent are unsure.

*The Small Business Trends survey was performed before the January 2021 stimulus act was implemented.

The plurality of POC entrepreneurs are confident about small business in a post-COVID world, at 43 percent versus 38 percent who are unconfident and 17 percent who are neutral. Again, white small business owners have higher expectations than POC, with 51 percent of white small business owners confident about the future of small business. However, on a five-point scale from very unconfident to very confident, both groups are neutral on average.

Just over half of POC-owned small businesses surveyed received economic relief through a Paycheck Protection Program (PPP) or Economic Injury Disaster Loan (EIDL), while 67 percent of white-owned businesses received either form of financial aid. On average, 61 percent of small business owners received governmental economic relief.

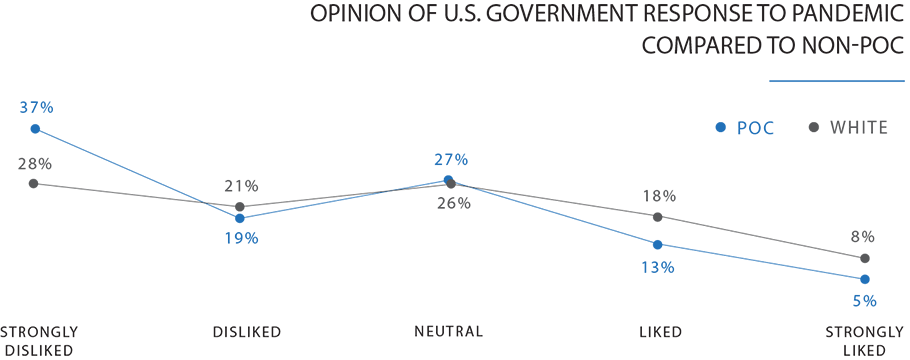

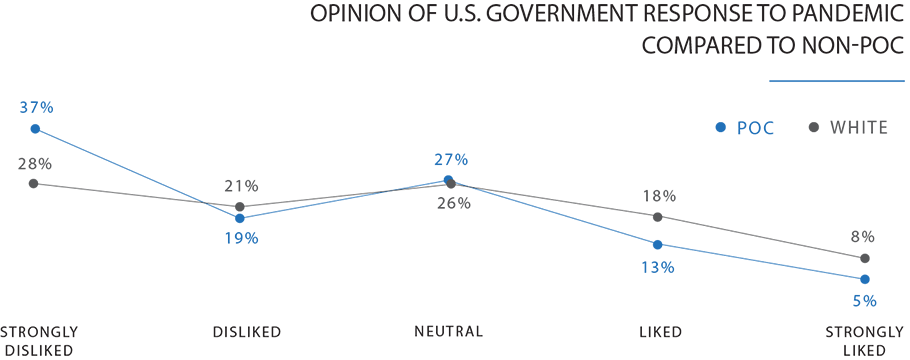

The lack of governmental relief aid may be part of why POC small business owners had a much less favorable view of the US government’s response to the COVID pandemic. While both POC and white small business owners on average were neutral to disliking the government response on a five-point scale, 56 percent of POC surveyed either disliked the response, compared to 49 percent of white entrepreneurs. About the same percent of both groups remained neutral on the response, at 27 percent and 26 percent respectively. Only 18 percent of POC small business owners liked the government’s COVID response, versus 26 percent of their white counterparts.

On average, both POC and white small businesses owners are neutral on how confident they feel about small business given the political climate. POC, like other future-looking topics, skew towards being more neutral or unconfident, which may result from their greater struggles during COVID and with receiving financial aid.

In a stark demonstration of the challenges in recent American politics, 45 percent of POC small business owners said they didn’t belong to or didn’t feel represented by any existing US political party. Thirty-three percent of POC small business owners surveyed said that the Democratic party most closely represented their political views, compared to 21 percent of white small business owners. Only seventeen percent said they felt represented by the Republican party, compared to 45 percent of white entrepreneurs. *

* Note: The Small Business Trends survey was performed before the events of January 6, 2021 at the US Capitol.

The majority of POC small business owners voted for Joe Biden in the 2020 US presidential election, at 70 percent, while Biden only received votes from 38 percent of white respondents. Only ten percent of POC respondents voted for Donald Trump, compared to 52 percent of white small business owners. A higher number of POC small business owners (21 percent) either voted for another candidate or didn’t vote at all versus their white counterparts (10 percent).

What Is It Like Being a POC Small Business Owner in 2021?

Though the COVID pandemic has created numerous challenges for POC communities, these small business owners remain happy owning their businesses. On average, POC respondents are somewhat happy as small business owners on a five-point scale from very unhappy to very happy. It is important to note that double the percent of POC small business owners were very unhappy compared to white small business owners (12 percent versus six percent), and 17 percent were neutral compared to only nine percent.

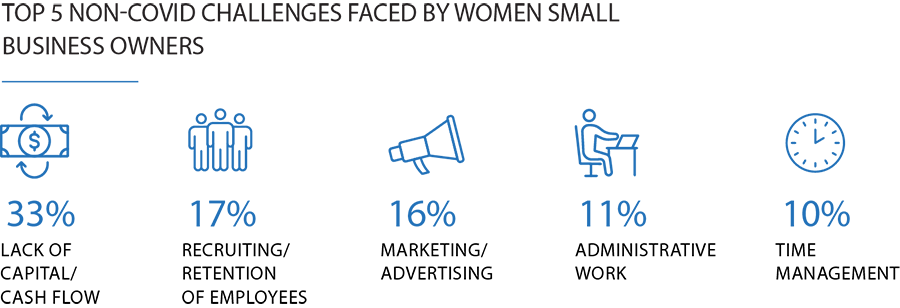

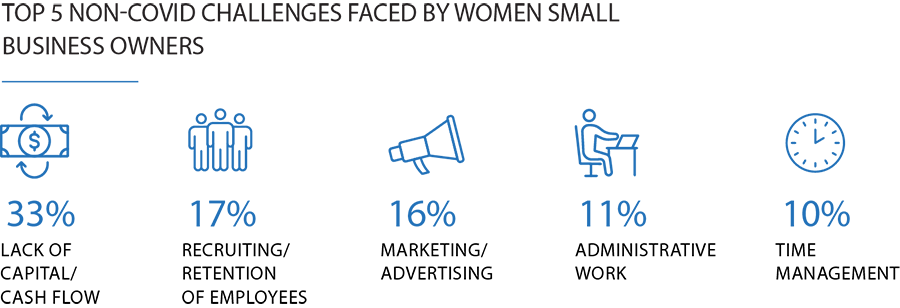

Lack of capital or cash flow remains the biggest non-COVID challenge for POC small business owners, as it has been in the last few years. Thirty-three percent of respondents reported lack of capital or cash flow as one of their greatest problems, while recruiting and retention of employees received 17 percent of the share and marketing and advertising received 16 percent. Only 20 percent of the share of white respondents said cash was their biggest challenge in the last twelve months, demonstrating the greater challenges POC small business owners have in receiving funding.

Despite the difficulties raising funds, more POC small business owners (13 percent) want to open a new location of their business than their white counterparts (9 percent). POC small business owners also have big ambitions for the year, with 61 percent planning on expanding or remodeling their businesses, 51 percent investing in digital marketing, and 46 percent planning to increase their staff.

The Future for POC-Owned Small Businesses

While the disparity between POC- and white-owned small businesses is clear, part of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act includes significant funds to help “minority-owned” businesses in specific. Additionally, President Biden’s economic “Build Back Better” plan include making business aid more equitable across minority populations.

With more governmental assistance and a resilient, determined attitude for future success, POC-owned small businesses will sustain through 2021 and hopefully, begin to rebuild at the same time.

Additional Learning Resources

Ready to use your retirement funds to start your business?

Don’t have any more questions about ROBS? Great, let’s get the process started today!