Advantages of ROBS: Debt-Free Financing

Why do small business owners use ROBS to finance their business over so many of the other funding solutions available? While ROBS isn’t a fit for everyone, read on to learn why it’s been a successful option for thousands of entrepreneurs nationwide.

Why Business Owners Choose ROBS

In Chapter 1, we dove into the Rollover for Business Start-Up (ROBS) process and the history behind some of the rules and regulations that allow you to invest in your own small business. In Chapter 2, we’re diving into the advantages of ROBS as a debt-free business financing option.

Because ROBS isn’t as well known as traditional financing methods, ROBS (also known as 401(k) business financing) isn’t usually the first source of funding entrepreneurs seek out. Usually, aspiring business or franchise owners consider more known forms of financing, like Small Business Administration (SBA) loans, unsecured credit, or even portfolio loans — all which involve some form of collateral or risk to credit.

ROBS is different. It allows prospective business owners to fund or buy a new or existing independent business or franchise completely debt-free. This means in the crucial first few years of the business, you can focus your cash flow on growing your new business without the burden of a monthly loan payment.

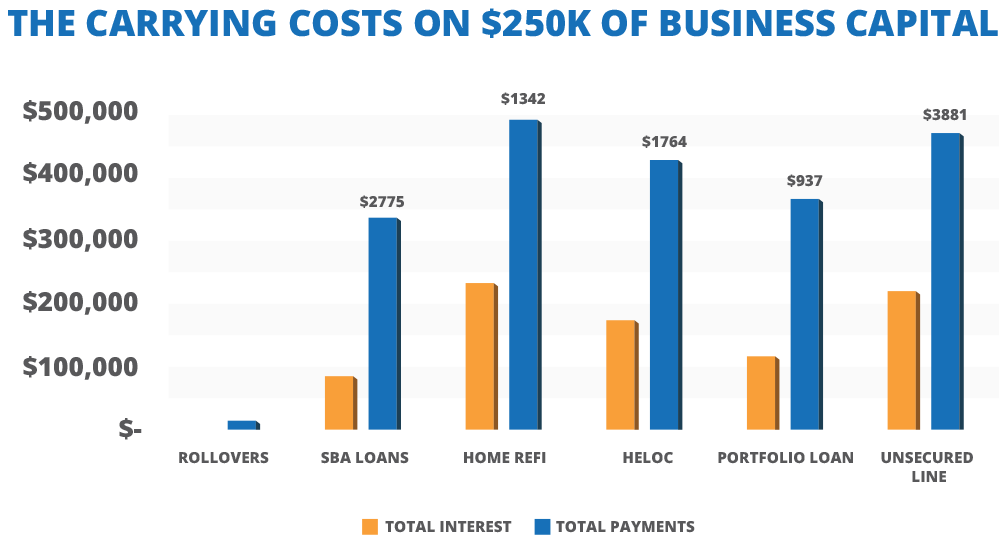

Below is a graph highlighting the average monthly payments for several popular funding options.

There are many other benefits of ROBS that prospective business owners may value. Among others, these ROBS benefits include:

1. Control of Your Future

Unlike investing in the stock market, with ROBS, you’re in control of your retirement funds. You may even eliminate the need to work with financial advisors and stockbrokers, who earn a commission off your investment choices. Not only do you have the opportunity to create the life you want, but you’re financially backing yourself. Who’s going to work harder with your money than you?

2. A Debt-free Beginning

There are no interest payments to make with 401(k) business financing. Without interest payments, you can reduce overhead. You could even reinvest more cash into growing your business because you don’t have debt to repay.

3. No Collateral to Qualify

You can get funding without using (and risking) any personal property as collateral.

4. It Holds You to a Higher Standard of Business Operations

One of the requirements of the ROBS arrangement is that you must create a C corporation and run it according to IRS and DOL guidelines. This means quarterly financial reviews with an accountant, business valuations, annual reports and filing IRS Form 5500, etc. In a nutshell, you’ll be required to know more about your business and how it runs than your typical entrepreneur, which is in the best interest of both your business and your investment. By being well educated, you’ll be able to make the best decisions for your company to keep in on track and improve performance.

5. A Quicker Path to Profitability

Using your retirement funds to finance a new business offers a tax-free, penalty-free way to access capital without borrowing money. Launching your business debt-free lowers overhead and eliminates monthly payments to a lender. Without loan payments, your new venture could become profitable sooner rather than later.

6. Tax-deferred Savings

Using ROBS lets you avoid the tax-penalty that normally occurs when withdrawing retirement funds early. This means you can put more of your money to work for you, rather than waste it on needless penalties. The funding transaction isn’t a loan, so it doesn’t need monthly payments with interest. You still can make salary deferrals into your new 401(k) plan and continue saving for retirement. As your business succeeds, the value of your stock rises, which increases the return on investment for your retirement account.

7. History of Successful Business Launches

While investing in a new business does come with risks, 81 percent of Guidant clients who have funded their business with ROBS have remained in business past the four-year mark.

8. Employer-Sponsored 401(k) Plan

As a part of the funding structure, your new business sponsors a 401(k) plan, which is then offered to employees. It’s rare for small businesses today to offer benefits that include a 401(k) plan, so a retirement plan also acts as a valuable recruiting tool.

9. ROBS as a Down Payment

If you need extra funds, you can use ROBS to fund the down payment on the SBA loan. ROBS can also be used as your down payment if your business deal involves seller financing.

According to a Guidant Financial survey, entrepreneurs considered minimizing debt and controlling investment performance to be the two most important benefits of buying a business with retirement funds.

10. It Offers a Competitive Edge for Employees

The ROBS arrangement can put a business ahead of its competition because they have significantly less debt to pay back. What’s more, under the ROBS arrangement, the business’s C corporation must sponsor a retirement plan and offer it to all eligible employees. This allows the business to recruit and retain higher caliber employees with the potential for contribution matching and profit sharing.

Taking a Taxable Distribution or Loan Vs. Funding With ROBS

When does it make sense to take a taxable distribution or loan from your retirement plan instead of using ROBS? If you’re hoping to access your retirement funds to fund a business, there are several things to consider. No one answer covers every scenario.

Taking a taxable distribution results in penalties owed to the IRS. Borrowing from your retirement plan means making loan and interest payments. However, ROBS may not always make the most financial sense, either. We’ve found that for most of our clients, rolling over at least $50,000 from their qualified retirement account makes the most financial sense. With fewer funds, it can be more cost-effective to take a loan or taxable distribution.

Here’s a scenario to help better explain:

Greg needs $50,000 to buy a coffee stand franchise. He doesn’t have that much cash on-hand, but he does have $100,000 in a qualified retirement account. Greg’s options are as follows:

401(k) Business Financing Because of the complexity of the ROBS structure, Greg would be working with a ROBS provider. The ROBS provider will charge a setup fee. Depending on the quality of the provider, the fee can vary from $3,000 to $5,000. If Greg decides to work with a more experienced provider, he’ll be on the higher end of that range. Considering he only needs $50,000, Greg would be paying an extra 10 percent of his funding amount to access the funds.

Taking a Distribution To avoid working with a third-party provider, but still access the $50,000, Greg considers taking A distribution. The year the funds are withdrawn, he’ll be required to claim that $50,000 as income and pay taxes on that amount. The percent he’ll pay depends on his tax bracket, but let’s say Greg would be required to pay 30 percent. Additionally, if Greg isn’t 59 and a half years old, he’ll have to pay an extra 10 percent penalty. After taxes and penalties, to access that $50,000, Greg would end up paying $20,000 (40 percent) in taxes.

Taking a Loan Greg contacts the custodian of his retirement account to learn about taking a loan against it. The investment firm tells Greg that he can only borrow up to 50 percent of the total value of his 401(k) account, $50,000. The terms of the loan will be executed at a five percent interest rate paid over five years. To access the $50,000, Greg would be taking on a monthly payment of $943 for five years.

From a pure cost of capital perspective in this example, it would make more sense for Greg to take a loan since it would only cost him five percent. There are scenarios where if Greg took a massive loss in his retirement account that year, taking the distribution wouldn’t result in additional tax burden.

Read more about 401(k) loans versus 401(k) business financing here.

As you can see, every scenario is different. Each option has pros and cons. A good rule of thumb is that if you need $50,000 or less, you should explore what taking a distribution or a loan is like in your scenario before committing to ROBS.

Using ROBS as a Down Payment for Seller Financing or SBA Loans

ROBS provides an alternative way to manage a down payment on a larger business loan. While ROBS has many stand-alone benefits, like tax-deferredd savings and debt-free financing, it can also be combined with other funding methods to increase buying power.

How ROBS and SBA Work Together

Using ROBS in combination with an SBA loan lets entrepreneurs use their retirement funds for the down payment on a loan. The combination preserves your savings for later use and gives lenders the proof they need to know the borrower can make ongoing repayments. It’s also a great option for those who can’t afford to or don’t want to pay their down payment out-of-pocket.

Almost half of all Guidant clients who apply for an SBA loan get their initial down payment (also known as an equity injection) via 401(k) business funding.

How ROBS and Seller Financing Work Together

Seller financing is increasingly becoming a part of buying (and selling) an existing business. Since most buyers don’t have hundreds of thousands of dollars in liquid capital, seller financing can be the bridge to business ownership. Combining ROBS and seller financing works so well because the seller usually only funds up to 60 percent (though that varies a lot depending on the seller’s situation).

The same diagram for how an SBA loan and ROBS works holds true for seller financing. The only difference is instead of handing the money to the bank as a down payment; you’ll be giving it to the seller. Sixty to 90 percent of businesses for sale may allow for some level of seller financing. Knowing how you can use ROBS for that down payment gives you access to a much greater share of the market.

Read more about using ROBS for cash on hand while searching for a business.

Benefits of Combining ROBS with SBA or Seller Financing

Save money SBA and seller financing loans are known for their low-interest rates and affordable monthly payments. Plus, ROBS allows you to use your retirement funds without incurring tax penalties.

Fulfill the capital requirement SBA loans require up to a 30 percent down payment, while Seller Financing can be even greater. Using your retirement funds as the down payment shows the lender or seller that you’re vested and responsible.

Preserve your savings Using your retirement funds as the loan down payment lets you avoid pulling from your own cash reserves.

Increase your buying power A bigger down payment helps to qualify you for a larger funding amount and better loan terms.

Getting Set Up with ROBS and SBA or Seller Financing

Once you’re qualified for an SBA loan or come to terms with seller financing, it’s time to start the ROBS arrangement. If you’re working with Guidant Financial, we’ll be by your side to help with this process. We’ll be there to ensure your down payment is handled as smoothly as possible.

Pre-Qualify Today!